WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/08/2025

Bonds opened under renewed pressure this Monday morning, extending the worst selling week since the late October Fed announcement. Treasury yields are testing the upper boundary of their medium-term range as markets brace for this week’s Federal Open Market Committee meeting. The 10-year yield climbed to 4.176%, while UMBS 5.0 coupons dropped 17 basis points from Friday’s close.

Lenders who priced early this morning are already seeing significant negative repricing pressure. The bond market’s weakness reflects preparation for Wednesday’s expected 25 basis point Fed rate cut, though the central bank appears increasingly divided on future policy. Markets are pricing in roughly 84% odds of a quarter-point reduction, but Chair Powell’s press conference tone will be critical for signaling 2026 direction.

Recent economic data suggests this week’s decision won’t be unanimous, with dissent expected from both hawks and doves. Treasury auction activity adds complexity to an already volatile week, with $58 billion in 3-year notes selling today. The combination of Fed uncertainty, Treasury supply, and reduced year-end liquidity creates a challenging environment for rate locks.

MBS selling accelerated sharply after the NYSE opening, with some jumpy lenders already repricing for the worse.

Locking vs Floating

Rates have consolidated ahead of Fed week, creating a short-term opportunity for risk-takers with limited attractive reward potential. The modest bump toward higher levels offers some tactical advantage, but meaningful moves require the more significant data and events coming Tuesday through December 16th.

Consider defensive positioning given the combination of Fed uncertainty, Treasury auctions, and reduced holiday liquidity affecting bond market momentum.

Today’s Events

– 11:00 AM: November Consumer Inflation Expectations

– 1:00 PM: 3-Year Note Auction ($58 billion)

Bond Pricing

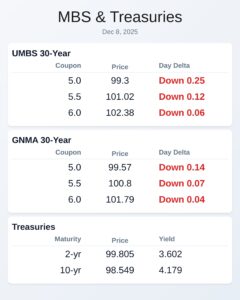

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.3 | -0.25 |

| 5.5 | 101.02 | -0.12 |

| 6.0 | 102.38 | -0.06 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.57 | -0.14 |

| 5.5 | 100.8 | -0.07 |

| 6.0 | 101.79 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.602 | 99.805 | 0.041 |

| 3 yr | 3.633 | 99.625 | 0.045 |

| 5 yr | 3.764 | 99.373 | 0.051 |

| 7 yr | 3.955 | 98.755 | 0.051 |

| 10 yr | 4.179 | 98.549 | 0.042 |

| 30 yr | 4.822 | 96.899 | 0.03 |