WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/15/2025

This week marks the return of more timely Bureau of Labor Statistics data that drives mortgage markets. The Employment Situation (jobs report) comes Tuesday and Consumer Price Index on Thursday, finally getting back on schedule after the government shutdown. These reports could easily set the tone through early January, for better or worse.

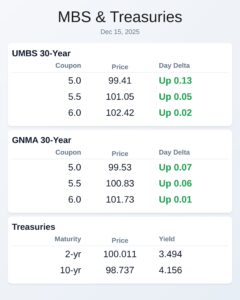

UMBS securities started Monday modestly stronger, with the 5.0 coupon up 14 basis points to 99.41. GNMA 5.0s gained 7 basis points to 99.53, showing consistent improvement across agency mortgage securities. This modest overnight strength held into the morning trading session.

The NY Fed Manufacturing Index delivered a harsh reality check, plunging to -3.9 versus expectations of 10.0. This represents a dramatic 22-point swing from November’s 18.7 reading, suggesting manufacturing activity contracted sharply in December. For mortgage originators, weaker economic data typically supports bond prices and can help with rate competitiveness.

Federal Reserve Chair Powell recently acknowledged the housing market faces “really significant challenges” that a 25 basis point rate cut won’t resolve. VantageScore CEO Silvio Tavares called the average credit score of 701 “pretty healthy,” but warned of a concerning split where prime borrowers are moving to super-prime or slipping into subprime categories. Lower-income consumers are seeing increased delinquencies while higher and middle-income late payments have actually fallen.

This week brings delayed employment and inflation data that could clarify which side of the Fed’s dual mandate deserves greater attention. Economists project 50,000 new jobs and a 4.5% unemployment rate for November. If the data sends a unified message of economic strength (higher jobs, higher inflation), an unfriendly range breakout becomes likely for bond yields.

Trump’s executive order targeting unified AI regulations could impact mortgage technology deployment across the industry. The order aims to block states from enforcing their own AI rules, creating “one central source of approval” according to White House AI adviser David Sacks. This regulatory clarity may accelerate mortgage lenders’ adoption of AI-powered underwriting and processing tools.

Locking vs Floating

Bonds ignored their post-Fed rally impulse and yields ended last week near recent range highs. This week could easily prompt an unfriendly breakout or push toward the lower range boundary. The outcome depends heavily on Tuesday’s jobs report and Thursday’s CPI data, with markets particularly sensitive to any unified economic message.

Today’s Events

– 8:30 AM: NY Fed Manufacturing (actual -3.9 vs 10.0 forecast)

– 10:00 AM: NAHB Housing Market Index (forecast 38 vs 38 prior)

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.41 | 0.13 |

| 5.5 | 101.05 | 0.05 |

| 6.0 | 102.42 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.53 | 0.07 |

| 5.5 | 100.83 | 0.06 |

| 6.0 | 101.73 | 0.01 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.494 | 100.011 | -0.028 |

| 3 yr | 3.546 | 99.871 | -0.031 |

| 5 yr | 3.708 | 99.624 | -0.034 |

| 7 yr | 3.913 | 99.012 | -0.031 |

| 10 yr | 4.156 | 98.737 | -0.028 |

| 30 yr | 4.822 | 96.891 | -0.019 |