WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/08/2025

Mortgage bonds face renewed pressure as we kick off another challenging week in the secondary market. The 30-year UMBS 5.0 coupon dropped 25 basis points today, marking the sharpest decline since last week’s brutal selloff. This weakness comes at the worst possible time, with Fed week approaching and year-end liquidity already thinning.

Treasury yields continue testing their recent highs, with the 10-year note climbing above 4.17% during afternoon trading. The bond market appears to be bracing for another potentially unfriendly Fed announcement, following last month’s hawkish surprise. When yields push this high this fast, mortgage originators typically see rate sheets deteriorate within hours.

FHFA and FICO finally reached agreement to release historical FICO Score 10T data, ending months of industry criticism over stalled negotiations. This breakthrough enables the mortgage industry to evaluate and potentially adopt the new credit scoring model, with GSEs expected to validate the data and make expanded datasets available through 2025. The move represents a significant step toward increasing competition in credit scoring, which could benefit both lenders and borrowers down the road.

The Consumer Financial Protection Bureau’s top enforcement official resigned last week, citing frustration with the Trump administration’s decision to halt virtually all agency enforcement activities. Michael Salemi, the CFPB’s principal deputy enforcement director, expressed concerns that there’s “no path to an effective future enforcement program at the Bureau” under current leadership. His departure adds to growing uncertainty about regulatory oversight in the mortgage industry.

Locking vs Floating

Rates have consolidated ahead of Fed week, but today’s selling pressure creates a short-term opportunity for risk-takers willing to float. The modest bump toward higher levels doesn’t offer especially attractive rewards compared to the downside risks ahead. More meaningful moves will likely wait for Tuesday’s JOLTS data and Wednesday’s Fed announcement, making this a challenging environment for timing decisions.

Today’s Events

No major economic data releases today, but Treasury auctions dominate the calendar with $58 billion in 3-year notes at 1:00 PM ET.

Bond Pricing

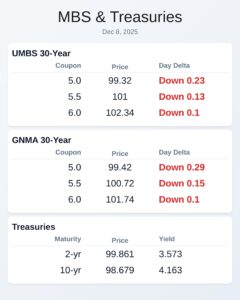

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.3 | -0.25 |

| 5.5 | 101.02 | -0.12 |

| 6.0 | 102.38 | -0.06 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.57 | -0.14 |

| 5.5 | 100.8 | -0.07 |

| 6.0 | 101.79 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.602 | 99.805 | 0.041 |

| 3 yr | 3.633 | 99.625 | 0.045 |

| 5 yr | 3.764 | 99.373 | 0.051 |

| 7 yr | 3.955 | 98.755 | 0.051 |

| 10 yr | 4.179 | 98.549 | 0.042 |

| 30 yr | 4.822 | 96.899 | 0.03 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.