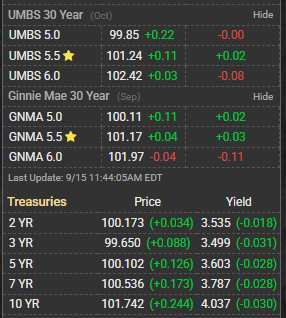

WTMS Blog Today = What’s up in Mortgage Today (AM) – 09/16/2025** Mortgage backed securities are showing mixed signals today as the 10-year Treasury yield eased to 4.04%, marking a decrease from the previous session. This movement in the benchmark Treasury has created some breathing room for mortgage markets, though pricing remains volatile. The UMBS market is responding cautiously to recent economic data releases that continue to paint a picture of economic uncertainty. National mortgage rates are currently averaging 6.37% on 30-year fixed loans, remaining below the psychological 7% threshold that many industry experts view as a critical resistance level.

This rate environment reflects the ongoing tension between inflationary pressures and economic growth concerns. Lenders are maintaining cautious pricing strategies as they navigate the current interest rate landscape. Recent consumer price data showing annual inflation at 2.9% in August has provided some support to bond markets, contributing to today’s Treasury yield decline. Weekly jobless claims data also continues to influence trading decisions in the mortgage backed securities space. These economic indicators are being closely watched by traders and originators alike for signs of Federal Reserve policy direction. The mortgage origination business continues to face headwinds from the elevated rate environment, with purchase activity remaining below historical norms. Refinance volume stays suppressed as the majority of existing homeowners hold mortgages at rates significantly below current market levels.

Industry professionals are focusing on purchase business and exploring alternative lending products to maintain volume. Real estate sales activity remains challenged by affordability concerns and limited inventory in many markets. The combination of higher mortgage rates and elevated home prices continues to price out many potential buyers. Market participants are closely monitoring upcoming economic releases and Federal Reserve communications for potential shifts in monetary policy that could impact mortgage markets.

Subscribe to get this vital mortgage market intelligence delivered to your inbox daily, for free, and stay ahead of the curve in today’s rapidly changing mortgage landscape.