WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/20/2026

Markets received a mixed bag of economic data that failed to inspire significant movement in either direction. Core PCE inflation came in hotter than expected at 0.4% monthly versus 0.3% forecast, while annual core PCE jumped to 3.0% from 2.8% previously. This uptick in the Fed’s preferred inflation gauge adds complexity to future monetary policy decisions.

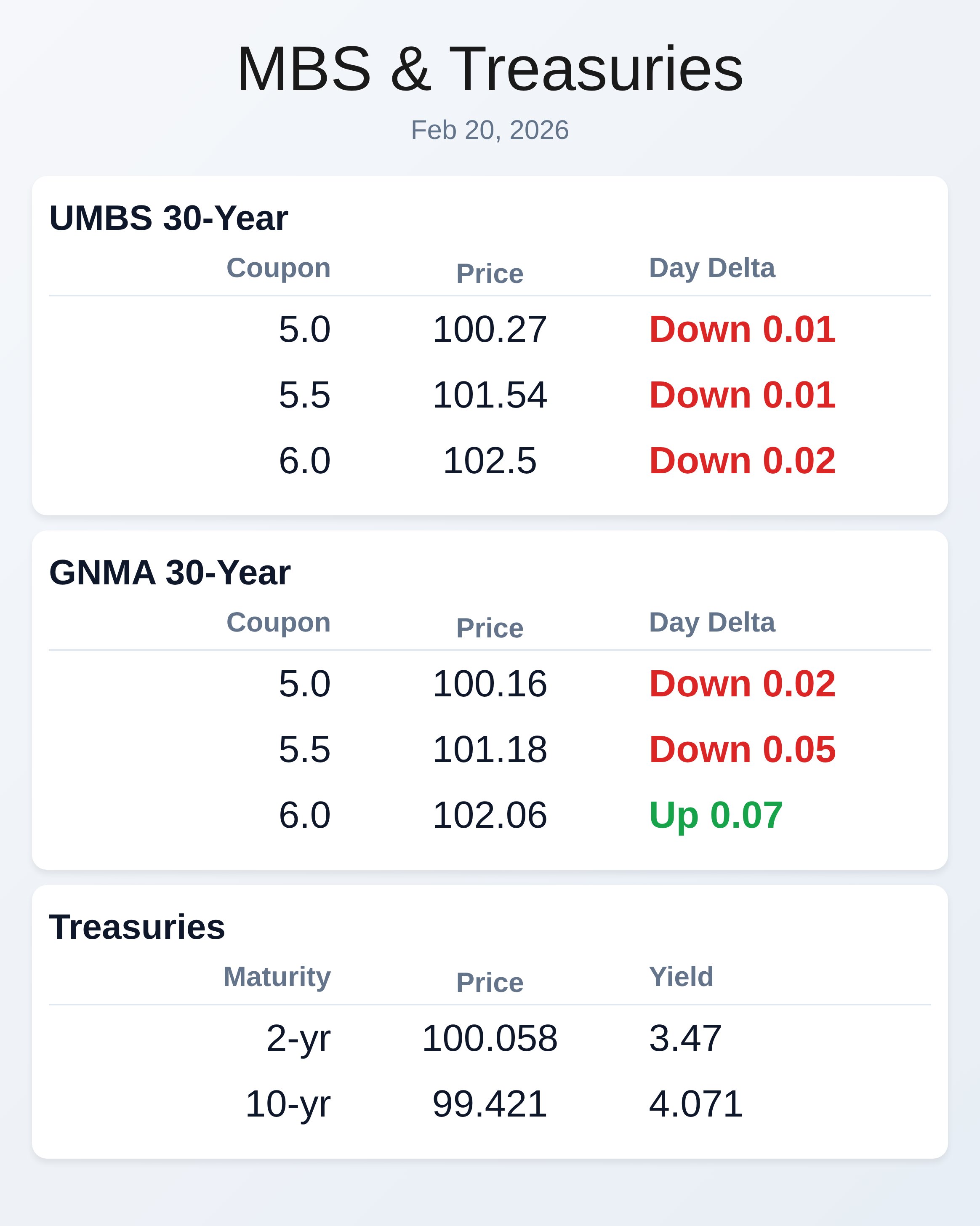

Meanwhile, Q4 GDP disappointed dramatically at just 1.4% versus 3.0% forecasted, showing economic growth cooling faster than anticipated. UMBS securities traded relatively flat with minor pressure across coupons. The 5.0 coupon held steady at 100.27 with minimal daily change, while higher coupons like the 6.0 showed slightly more weakness dropping 2 basis points.

GNMA securities displayed mixed performance with the 6.0 coupon actually gaining 7 basis points, suggesting some rotation between security types. Treasury markets showed modest strength overnight but gave back gains after the data release. The 10-year yield sits at 4.071%, down just 5 basis points for the session despite the inflation surprise.

This muted reaction suggests traders are weighing the conflicting signals from higher inflation against weaker growth data.

Locking vs Floating

Thursday’s bond market showed little conviction in either direction, setting up today’s busy economic calendar as the key driver. With rates sitting near long-term lows, risk-averse clients should maintain their lock bias given the potential for rapid changes.

The combination of hotter inflation and weaker growth creates a two-way risk environment where data surprises could trigger quick movements before rate sheets are released.

Today’s Events

– Core PCE (m/m) (Dec): 0.4% vs 0.3% forecast

– Core PCE (y/y) (Dec): 3.0% vs 2.9% forecast

– GDP Q4: 1.4% vs 3.0% forecast

– PCE (y/y) (Dec): 2.9% vs 2.8% forecast

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.27 | -0.01 |

| 5.5 | 101.54 | -0.01 |

| 6.0 | 102.5 | -0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.16 | -0.02 |

| 5.5 | 101.18 | -0.05 |

| 6.0 | 102.06 | 0.07 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.47 | 100.058 | 0.005 |

| 3 yr | 3.497 | 100.009 | 0.008 |

| 5 yr | 3.645 | 100.478 | 0.01 |

| 7 yr | 3.84 | 100.975 | 0.002 |

| 10 yr | 4.071 | 99.421 | -0.005 |

| 30 yr | 4.702 | 98.775 | 0.005 |