Thursday – July 11, 2024

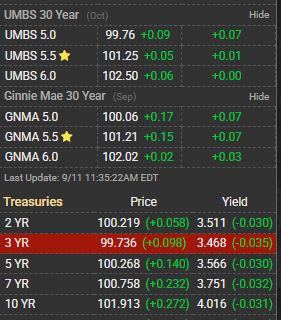

Oooooh-Weee. UMBS are up 41 bps on the open, so far. S&P futures down 9.5 points

Headline CPI M/M = -0.1 vs 0.1% f’cast, [0.0 prev]

Headline CPI Y/Y = 3.0% vs 3.1% f’cast, [3.3% Prev]

Core CPI M/M = 0.1 vs 0.2 f’cast, [0.2 prev]

Core CPI Y/Y = 3.3 vs 3.4 f’cast, [3.4 prev]

Pretty straightforward outcome here. CPI was high stakes and this is quite a bit lower than expected. Bonds are rallying about as much as you’d expect, given the set-up.

Energy prices fell overall, which was offset by increases in shelter. Used Car prices were down 10% on a year-over-year basis. Food index increased 0.2% in June after rising 0.1% in May

The September Fed Funds futures now see a 80% chance of a rate cut at the September meeting.

The U.S. trade deficit steadily improved from a monthly high of $102 billion in 3/22 to $60 billion in 8/23, and the improvement unsurprisingly boosted GDP growth. Since then, however, it has worsened in eight of the last nine months and now stands at -$75 billion. The worsening trade deficit reduced 24Q1 GDP by 0.65 of a percentage point and the 24Q2 impact is likely to be meaningfully worse.

Today’s CPI data was hotly anticipated, to say the least, and it did a borderline heroic job of advocating for a huge drop in rates. Not only did the core M/M number drop to an unrounded 0.065 (implies core annual inflation UNDER 1.0%) but shelter inflation dropped to the lowest levels since the start of the pandemic, roughly in line with the bottom of the pre-pandemic range. Those ingredients would have allowed the market to cook up a much bigger rally than we saw today, even though we saw the 2nd biggest mortgage rate drop in 2024. A slower pace is more sustainable. Markets want to do things right this time.

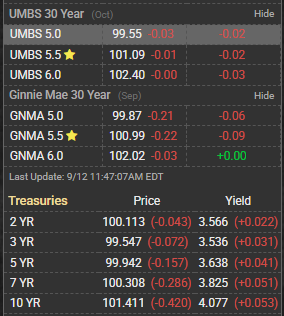

UMBS ended the day up 22 bps at 100.92. Which is down 18 bps from the high of the day.