Wednesday – October 9, 2024

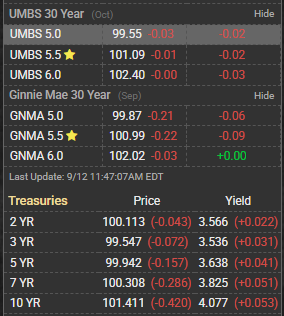

UMBS on the wrong side of up on the open. Down 6 bps.

Stock futures down 3 points. Stocks are lower as the Federal Government considers an antitrust suit against Google, which is dragging down sentiment against Big Tech. Bonds and MBS are flat.

This week’s economic calendar is choked with Fed speeches and most of them are happening today. Collectively, those will be more relevant than the release of the Minutes from the most recent Fed meeting (because that was 3 weeks ago, but anything before the last jobs report might as well be an eternity).

US equity futures wavered as Treasury yields held above 4%, and concerns over a potential antitrust crackdown on Alphabet Inc. weighed on markets. Alphabet’s shares fell after the US Justice Department suggested Google may need to sell parts of its search business. Investors are also focused on the Fed meeting minutes and upcoming US inflation data, with rising Treasury yields dampening rate-cut expectations. Despite global economic uncertainty, some investors remain optimistic about a soft landing for the US economy.

In the Macro – Through the first 11 months of FY24, federal spending rose $392 billion or 7%, while revenues increased by a healthy but smaller 5.5%. Debt service rose by $227 billion and Social Security/Medicare increased by $174 billion. Other categories that bumped up were defense, which increased by $52 billion and veterans’ benefits by $40 billion. Outlays on all remaining programs fell $100 billion. This is why reducing spending is so tough.

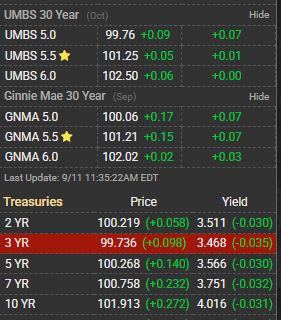

Bonds lost a bit of ground on Wednesday with Treasuries having a far rougher go of it than MBS, but not by much, ultimately. If one had to guess at reasons for the MBS Outperformance on a Treasury auction week, blaming the Treasury auction cycle is the easiest solution. In so doing, we’re also planning on the next rally being better for Treasuries than it would be for MBS.

The present weakness doesn’t have any good, immediate justifications. This is how the choppy, sideways drift is playing out after the initial rate spike that followed Friday’s jobs report. The worst may be over, but that doesn’t mean bond weakness is over. As for salvation, don’t expect miracles from Thursday’s CPI. It likely has the potential to calm some nerves if it comes in much lower than expected, but even more potential to reinvigorate the sell-off if it comes in much higher.

UMBS closed the day down 19 bps at 100.29