Wednesday – October 23, 2024

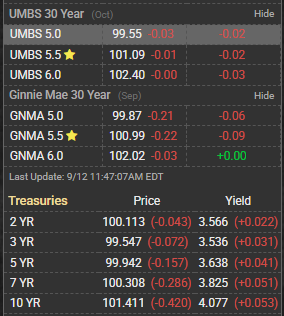

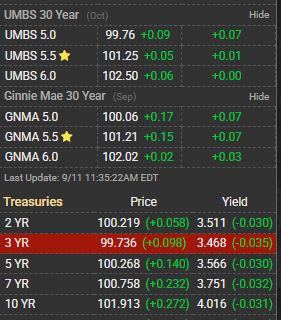

UMBS were – again – down big in the morning. Down 24 bps in the first hour. S&P futures down 14 bps.

Bonds began the day in weaker territory and have been losing ground gradually since the open. Negative reprice risk isn’t necessarily an immediate concern as most lenders are either not yet out with prices or didn’t price early enough in the day to be seeing the brunt of this sell-off. Lenders with overnight price protection, on the other hand, are certain to be opening with higher rates.

The next few days and weeks might get a little repetitive, but the gravity of the message bears repeating. There are two distinct categories of motivation for bonds right now: the election and the economic data. By extension, the data also has a bearing on the Fed in case you were wondering why the Fed isn’t on that list.

The election is only likely to put more upward pressure on rates between now and election day. Then, depending on the winner and the Senate elections (red sweep is the biggest fear for rates), there would be a big pop higher or lower.

Meanwhile, econ data is as important as ever, with traders fearing that next week’s jobs report could frame the summertime labor market slowdown as a big head fake. If that happens, and if the “red sweep” becomes a reality, a 10yr yield at 5% would not be a surprise. After all, yields were able to hit 5.0% without having to worry about election outcomes, and they were able to hit 4.75% earlier this year simply because we weren’t getting enough reassurance about the rate narrative in the econ data. Last thing to consider is that the 10yr could hit 4.50% next week WITHOUT breaking out of the broader downtrend. In other words, there would be no great reason for bond bulls to push back against sellers up to those levels.

Although polling data indicates a close race, betting markets are increasingly predicting a Trump win. Both sides accuse the other of “painting the tape” with Democrats accusing foreign bad actors of placing big bets to influence the odds, while Republicans accuse Democrats of releasing partisan, over-D sampled polls into the overall mix.

Presumably, a Trump win would be bad for bonds as tariffs would raise prices, and a more pro-business regulatory regime would be better for the economy overall, which will keep the Fed from cutting rates as aggressively. A Trump Presidency would also bring back the debate over what to do with the GSEs.

Blackstone Inc. Chief Executive Officer Steve Schwarzman said the US is likely to avoid a recession regardless of who wins the presidential election, as both candidates have policy proposals that appeal to growth. “I don’t see a recession risk because the economy is pretty strong and both of the candidates keep mentioning a lot of stimulative policies,” the billionaire private equity chief said Wednesday in an interview in Tokyo. “But time will tell as to what anybody actually will be able or want to do.”

Our morning commentary resulted in widespread questions regarding the “red sweep” being associated with higher rates. Half of those were born of genuine curiosity. Half were incredulous. As ever, our goal is to convey what’s moving markets and why, and it would be nearly impossible for anyone to be less interested in bringing politics into that endeavor, but alas, sometimes it’s a thing. Today’s recap video has a thorough analysis of the topic and should help clear up any questions created by the AM commentary.

UMBS closed the day down 25 bps at 99.33