Thursday – December 5, 2024

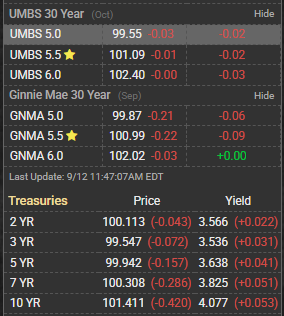

UMBS down 12 bps on the open. Stock futures are down 2.5 points

Jobless Claims = 224k vs 215k f’cast, [213k prev]

Continued Claims = 1871k vs 1910k f’cast, [1896k prev]

At first glance, the 224k figure in jobless claims may seem like a moderately positive thing for bonds, but our ongoing chart of non-seasonally adjusted data shows that it’s a bit misleading. This was actually the lowest claims reading on a non-adjusted basis than any of the other years in our comparison. In other words, zero signs of labor market weakness in this particular data and thus no surprise to see bonds moving back up a bit.

Jerome Powell said that the economy has been stronger than expected, and inflation has been higher than expected, which gives the Fed more room to be patient in reducing rates to approach r-star.

The ISM Services report showed that the services sector decelerated in November, with the index falling from 56% to 52.1%. Business Activity, Employment, and new orders all fell. Unfortunately, the prices index increased, albeit by a tiny amount. The decrease in the Services PMI® in November was driven by decreases in each of the four directly impacting subindexes (Business Activity, New Orders, Employment and Supplier Deliveries). However, 14 industries reported business activity growth, and 13 indicated new orders expansion; both figures are improvements compared to October.

61% of the price of a new home is construction, including labor. Of the 61%, 56% (or 34% of the total price) is wages/salaries and 44% (or 27% of the price) is material. 7.3% of materials (or 2% of the total price) are imported. A median new home price of $440,000 means $9,000 in imported materials. Assuming a 30% tariff, that means new home prices rise by, at most, $3,000.

Bonds were slightly weaker overnight and did just a bit more selling after the Jobless Claims data, but the losses were erased by the early afternoon. Even then, they were never that big in the first place. The muted volatility fit nicely in a week where the tone has been decidedly calm and the range has been reliably narrow. It’s also a perfect set up for the report that always reserves the right to rock the boat (Friday morning’s jobs report). Expectations are for a fairly middle-of-the-road 200k print for nonfarm payrolls and a slight uptick in the unemployment rate.

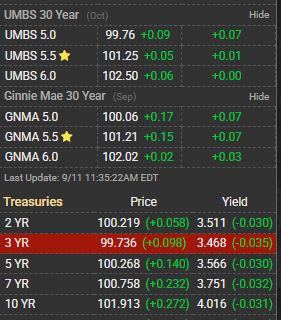

UMBS closed the day up 1 bp at 100.01