Mortgage Today (PM) 08/19/2025

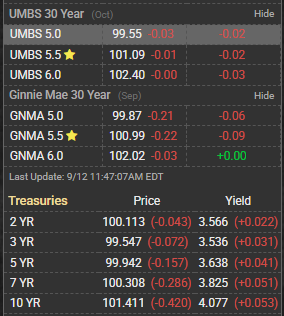

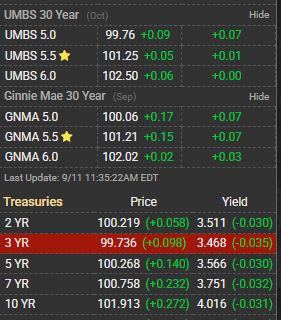

The mortgage-backed securities market experienced notable pressure today as MBS prices declined across the yield curve, with the benchmark UMBS 5.5% coupon losing approximately 6-8 basis points intraday. This weakness stemmed from broader Treasury volatility, with the 10-year Treasury yield fluctuating around 4.31% before settling lower at 4.313% from yesterday’s 4.332% close. GNMA securities mirrored UMBS performance, showing similar pricing deterioration as secondary market liquidity remained challenged.

Today’s economic data flow created mixed signals for bond traders, with inflation concerns competing against signs of economic moderation that could influence Federal Reserve policy direction. The Fed’s monetary policy stance remains critical as mortgage originators navigate an environment where small MBS pricing changes translate directly into borrower-facing rate adjustments. Primary mortgage rates held relatively steady despite the MBS weakness, though lenders maintained cautious pricing given the ongoing volatility.

Lock/float considerations favor a measured approach in this environment, with borrowers who haven’t locked potentially facing rate increases if MBS continue their downward trajectory. Originators should consider locking deals with extended closing timelines given the unpredictable nature of current bond market movements. The spread between MBS and Treasury securities remains elevated, reflecting continued uncertainty in mortgage credit markets and investor demand patterns. Housing market fundamentals continue to show resilience despite affordability challenges, with purchase applications maintaining stability even as refinance activity remains suppressed.

Today’s bond market action reinforces the importance of timing for both borrowers and loan officers, as small moves in MBS pricing can significantly impact deal profitability and borrower qualification scenarios. Subscribe to get this mortgage market intelligence delivered to your inbox daily, for free.