WTMS Blog Today = What’s up in Mortgage Today (AM) – 08/27/2025

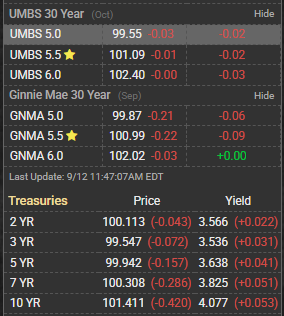

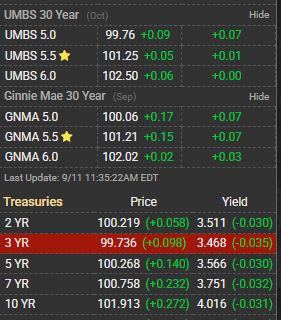

Mortgage-backed securities are showing mixed signals today as the 10-year Treasury yield climbed to 4.29%, up 0.02 percentage points from yesterday’s close. This uptick in yields typically pressures MBS pricing, though mortgage rates continue their recent downward trend with 30-year fixed rates dipping further to around 6.52%. The bond market is navigating between economic data signals and Federal Reserve policy expectations. UMBS (Uniform Mortgage-Backed Securities) pricing faced headwinds from the Treasury yield increase, though demand remains steady from institutional investors. GNMA securities maintained relative stability compared to conventional MBS, benefiting from their government backing during periods of yield volatility. The spread between MBS and Treasury securities remains within normal trading ranges.

Major mortgage originators are reporting improved application volumes as rates have pulled back from recent highs. Primary mortgage market activity is picking up with the rate decline, though purchase applications still lag refinance activity. Lenders are cautiously optimistic about pipeline growth heading into the traditionally slower fall season. The real estate sales market is responding positively to the mortgage rate improvements, with some regions seeing increased showing activity.

Home affordability remains a challenge, but the rate relief is providing opportunities for buyers who have been waiting on the sidelines. Industry analysts expect continued rate volatility as markets digest upcoming economic data releases. Subscribe to get this daily mortgage and bond market intelligence delivered to your inbox for free every morning.