**WTMS Blog Today = What’s up in Mortgage Today (AM) – 09/05/2025**

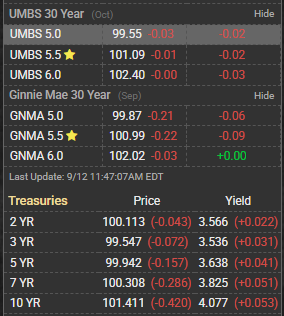

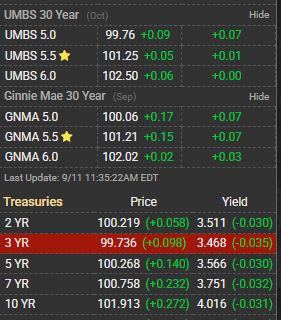

The mortgage-backed securities market showed positive momentum today, with UMBS prices experiencing modest gains that helped push mortgage rates back toward recent lows. The 30-year fixed rate dropped to 6.29%, down 16 basis points from yesterday’s levels, according to MBS Live data. This improvement comes as Treasury bonds also rallied, with the 10-year yield falling to 4.09%. Bond markets are finding support from renewed concerns about economic growth and potential Federal Reserve policy adjustments. The correlation between Treasury performance and MBS pricing remains strong, with both asset classes benefiting from flight-to-quality flows. Mortgage originators are closely watching these developments as they consider lock-float decisions for pending applications.

Housing market fundamentals continue to present mixed signals, with signed contracts for new and existing homes showing slight declines from June to July levels. Home prices remain elevated compared to last year, creating affordability challenges that are keeping many potential buyers on the sidelines. The combination of high prices and elevated mortgage rates continues to constrain purchase activity across most markets. Mortgage professionals are navigating a complex environment where small rate improvements can significantly impact borrower qualification and refinancing opportunities. The current rate environment suggests that borrowers who locked rates in recent weeks may want to evaluate potential re-lock opportunities if their loans haven’t yet closed. Market participants are positioning for additional economic data releases this week that could influence Fed policy expectations.

Any shifts in inflation expectations or employment trends could quickly reverse today’s bond market gains and impact mortgage pricing accordingly.

Subscribe to get this essential mortgage market intelligence delivered to your inbox daily, completely free.