**WTMS Blog Today = What’s up in Mortgage Today (AM) – 09/08/2025**

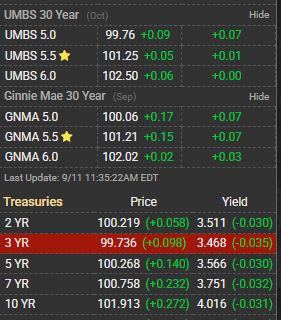

The mortgage backed securities market showed modest improvement this morning as the benchmark 10-year Treasury yield dropped more than 2 basis points to 4.059%. This movement reflects growing expectations that the Federal Reserve may need to adjust monetary policy in response to softening economic indicators. The 30-year fixed mortgage rate fell by 2.10% over the past week to 6.3%, providing some relief for potential homebuyers. UMBS pricing demonstrated resilience in early trading, with the 30-year 5.5% coupon showing steady performance amid renewed investor interest. GNMA securities followed suit, benefiting from the broader flight-to-quality trade that has characterized recent market sessions. The improvement in mortgage backed securities pricing comes as traders position ahead of key economic data releases later this week.

Market analysts are closely watching demographic shifts that could drive a new wave of homeownership demand, despite elevated rates. Barry Habib continues to highlight generational changes as a fundamental driver for mortgage origination volume in the coming years. The mortgage industry is adapting to these evolving patterns while navigating the current rate environment. Capital markets activity suggests bond traders are positioning for potentially weaker employment data, which could accelerate the timeline for Federal Reserve rate cuts. This positioning has created opportunities for mortgage originators to lock in better pricing for borrowers.

The interplay between economic data and Fed policy expectations remains the primary driver of day-to-day volatility in the mortgage market. Want to stay ahead of mortgage market movements and receive this analysis in your inbox daily? Subscribe now to get comprehensive mortgage market insights delivered free each morning, helping you make informed decisions in today’s dynamic lending environment.