WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/08/2025

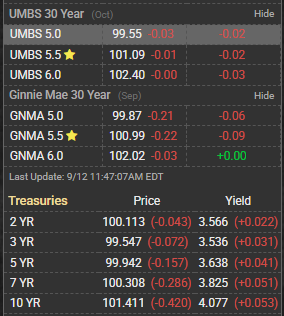

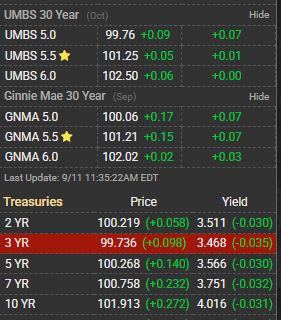

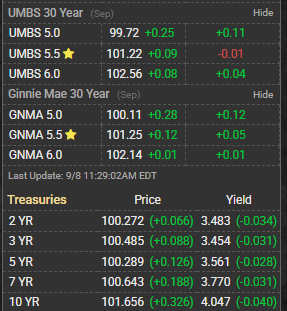

Mortgage-backed securities showed positive momentum today with rates sliding enough to capture homebuyers’ attention across the market. The 10-year Treasury yield eased to 4.04%, marking a 0.03 percentage point decrease from the previous session, providing some relief to mortgage originators and borrowers alike. UMBS pricing improved modestly with green arrows pointing upward on key mortgage securities benchmarks. The bond market rally appears driven by continued economic uncertainty and investor flight to quality, benefiting both Treasury and mortgage-backed securities. Ginnie Mae 30-year 5.5% securities held steady around the 98-22 level, showing resilience in the face of recent market volatility.

Lock-float considerations favor locking in current rates as any further improvements may be temporary given ongoing economic data releases. Mortgage originators are seeing increased application volume as rates dropped below key psychological levels that had been deterring potential homebuyers. The UMBS market specifically benefited from reduced supply concerns and steady demand from institutional investors seeking yield in the current environment. Capital markets desks are advising caution despite today’s gains, noting that upcoming economic data could quickly reverse these favorable conditions. Real estate professionals report renewed interest from buyers who had been sitting on the sidelines waiting for rate improvements.

The mortgage origination pipeline is showing signs of life with applications ticking higher across most loan categories. Industry observers note that while today’s rate decline is encouraging, sustained improvement will require broader economic stability. Subscribe to get this daily mortgage market intelligence delivered to your inbox for free and stay ahead of the rapidly changing bond and mortgage landscape.