# WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/09/2024

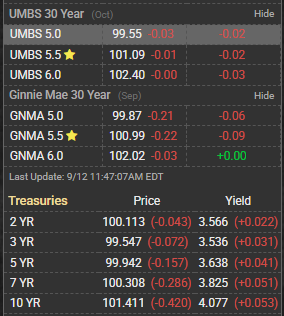

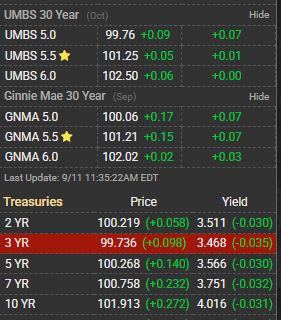

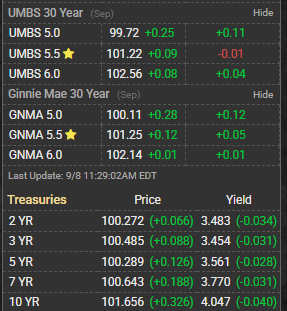

Mortgage backed securities markets showed modest gains today despite limited new economic catalysts, with UMBS prices holding steady after last week’s improved momentum. The 10-year Treasury yield opened at 4.045% and traded in a tight range between 4.04% and 4.091%, reflecting market uncertainty ahead of key economic data releases this week. Bond traders are positioning cautiously as they await Wednesday’s inflation data and potential Federal Reserve policy signals. Lock-float considerations favor locking in current rates given the technical resistance levels bonds face at these pricing levels. The absence of significant economic news has allowed mortgage backed securities to consolidate recent gains, but the market remains vulnerable to volatility from upcoming CPI data and Fed communications.

Originators should note that pricing improvements have been incremental rather than dramatic, suggesting a need for careful timing on rate commitments. GNMA securities continue to track closely with broader MBS movements, showing similar modest strength but facing the same technical headwinds. The mortgage origination environment remains challenging with volume constraints, though the recent rate improvements have generated some increased refinancing activity. Industry professionals are watching for any signs that the Federal Reserve may signal a more dovish stance at upcoming meetings.

The mortgage market’s correlation with Treasury movements remains high, making Wednesday’s inflation reading particularly important for rate trajectory. Current pricing suggests the market has largely priced in expectations for stable to slightly lower rates in the near term, but any surprises in economic data could quickly shift sentiment. Real estate sales activity has shown modest improvement with the recent rate declines, though transaction volumes remain below historical norms.

Subscribe to get this essential mortgage market intelligence delivered to your inbox daily, completely free.