WTMS Blog Today = What’s up in Mortgage Today (AM) – 09/12/2025

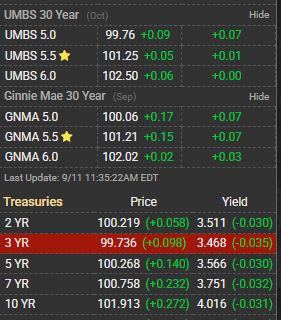

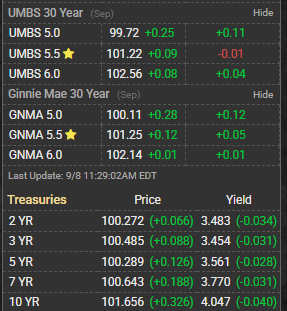

Mortgage-backed securities are showing signs of stability this morning as the 10-year Treasury yield hovers around 4.03%, slightly up from yesterday’s close of 4.011%. The bond market is positioning itself ahead of expected Federal Reserve policy decisions, with traders closely monitoring inflation data and employment figures. UMBS (Uniform Mortgage Backed Securities) pricing has remained relatively steady, though market participants are cautious about upcoming economic releases. Mortgage rates dropped again today, with 30-year fixed rates falling to 6.33% according to multiple industry sources. This decline comes despite the slight uptick in Treasury yields, indicating that mortgage lenders are becoming more competitive in their pricing. The spread between mortgage rates and Treasury yields has compressed, suggesting improved liquidity conditions in the secondary mortgage market. Market analysts are warning borrowers not to expect significant mortgage rate declines even if the Fed cuts interest rates in upcoming meetings.

The mortgage market often moves independently of Fed policy, influenced more by long-term bond yields and credit spreads. However, the current environment presents opportunities for strategic refinancing decisions for qualified borrowers. The mortgage origination business continues to face headwinds from persistent affordability challenges and inventory constraints in many markets. Lenders are adapting their strategies to focus on purchase money transactions as refinance activity remains subdued. Industry experts suggest that any meaningful improvement in mortgage demand will require sustained rate declines below current levels.

Real estate professionals are noting increased buyer activity in select markets where prices have stabilized, though overall transaction volumes remain below historical averages. The combination of elevated rates and home prices continues to sideline many potential buyers, particularly first-time homebuyers.

Subscribe to get this daily mortgage and bond market analysis delivered to your inbox each morning, completely free, so you never miss the critical market movements that impact your business.