**WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/19/2025**

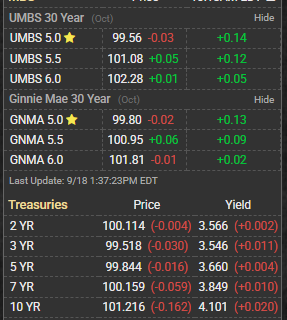

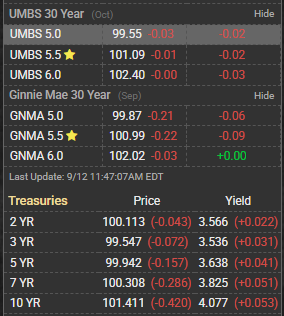

Treasury yields climbed higher today as investors continued to digest Wednesday’s Federal Reserve decision to cut interest rates by 50 basis points. The 10-year Treasury bond experienced price declines, with yields moving upward in what appears to be a post-Fed meeting adjustment period. This movement suggests market participants are reassessing their outlook following the larger-than-expected rate cut. Mortgage-backed securities faced pressure today as the broader bond market experienced volatility. The UMBS market showed signs of weakness with prices declining, indicated by red arrows pointing downward on major trading platforms.

This price deterioration in MBS typically translates to higher mortgage rates for consumers, creating a disconnect from the Fed’s rate cut intentions. Freddie Mac reported the weekly 30-year fixed mortgage rate average at 6.09%, down from the previous week, though this reading may not fully capture today’s bond market movements. The mortgage origination business continues to navigate challenging conditions as rate volatility creates uncertainty for both lenders and borrowers. Lock-float considerations remain critical as pricing windows have become increasingly narrow and unpredictable. Market analysts are noting that rates rallied hard into last September’s Fed rate cut and then bounced relentlessly higher afterward.

With average rates up about a quarter point from recent lows, the pattern suggests caution for those expecting immediate mortgage rate relief from Fed policy changes. The GNMA securities market has followed similar patterns, showing vulnerability to broader Treasury market movements. The mortgage industry continues to grapple with reduced origination volumes and margin compression. Lenders are adjusting their strategies as the traditional correlation between Fed rates and mortgage rates has become less reliable.

Real estate professionals are advising clients to focus on market fundamentals rather than timing interest rate cycles. Capital markets commentary from industry experts suggests the current environment requires careful attention to daily bond market movements. The disconnect between Fed policy intentions and actual mortgage rate outcomes highlights the complexity of today’s interest rate environment.

Subscribe to get this mortgage market analysis delivered to your inbox daily, for free, and stay ahead of the rapidly changing bond and mortgage landscape.