WTMS Blog Today = What’s up in Mortgage Today (09/24/2025)

Mortgage-backed securities (MBS) traded mixed today with overall pressure on prices, especially in the UMBS sector. While the UMBS 30-year coupon prices slipped by a few basis points, GNMA MBS exhibited moderate gains, signaling divergent investor sentiment towards these two key segments of mortgage securities. The UMBS 5.0 and 5.5 coupons saw declines, impacted by shifts in interest rate expectations and supply-demand dynamics in the secondary mortgage market. Conversely, GNMA 30-year prices for similar coupons modestly increased, reflecting a flight to security among government-backed pools. The U.S. Treasury market showed cautious trading as well, with the 10-year Treasury bond holding relatively steady but edging slightly higher in yield compared to the prior session. This mild increase in yields typically weighs on MBS prices given their inverse correlation to rates. The 10-year Treasury yield hovered just above 4.1%, maintaining pressure on mortgage rates but also reflecting ongoing economic uncertainty and inflation concerns.

Mortgage originations remain under strain amid these market conditions, with lenders adjusting pricing strategies. The cost to borrow continues to limit refinancing activity, though purchase loans retain demand as housing remains a key necessity for many buyers. Industry reports indicate cautious optimism, with some seasonal upticks being offset by elevated borrowing costs and tighter underwriting standards. On the real estate front, sales activity appears stable but subdued, constrained by affordability issues tied to the persistently higher mortgage interest rates. Homebuilders and realtors express concern over a slowdown in market pace, as buyers grapple with sticker shock from rising costs. Analysts highlight that the bond and mortgage markets are entering a consolidation phase, waiting for clearer signals from upcoming economic data releases.

The Federal Reserve’s policy stance remains a critical factor influencing treasury yields and mortgage spreads. Market watchers recommend close attention to inflation metrics and employment reports this week for clues on the trajectory of rates. To summarize, UMBS securities took a slight hit today in pricing, GNMA MBS showed resilience, and the 10-year Treasury yield nudged slightly upward, sustaining upward pressure on mortgage rates. Mortgage originators and real estate professionals are navigating these dynamics with cautious strategies as the marketplace absorbs economic signals. This environment underscores the importance of monitoring both fixed income and housing sector developments daily.

For detailed daily updates on the movement of mortgage-backed securities and treasury bonds, and what they mean for mortgage rates and housing markets, subscribe to receive this insightful analysis directly to your inbox, free every morning.

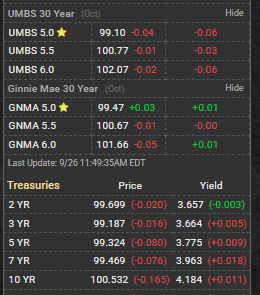

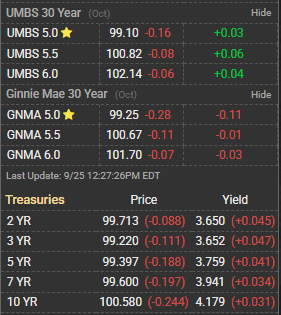

Real-Time Pricing

UMBS 30-Year:

– 5.0: Price 99.47, Day Δ -0.07

– 5.5: Price 101.05, Day Δ -0.02

– 6.0: Price 102.30, Day Δ +0.03

GNMA 30-Year:

– 5.0: Price 99.72, Day Δ +0.14

– 5.5: Price 100.91, Day Δ +0.09

– 6.0: Price 101.79, Day Δ +0.03

Treasuries:

– 2-yr: Price 100.094, Yield 3.576

– 5-yr: Price 99.743, Yield 3.682

– 10-yr: Price 100.996, Yield 4.127