**WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/25/2025**

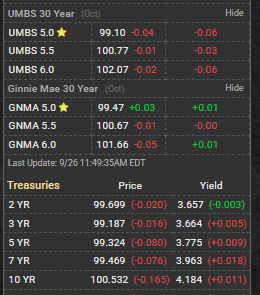

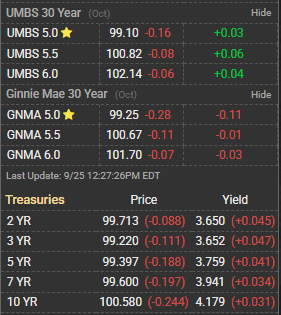

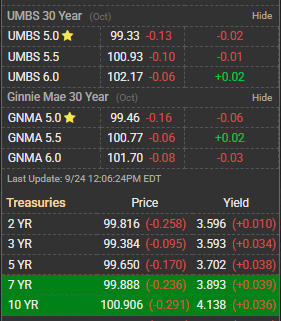

Bond markets faced headwinds today as mortgage-backed securities (MBS) pricing declined moderately, reflecting ongoing pressure from stronger-than-expected economic data. The 10-year Treasury yield climbed as investors reassessed Federal Reserve policy expectations following robust consumer confidence and durable goods reports. This movement created challenging conditions for mortgage origination, with UMBS securities showing particular weakness in afternoon trading. Mortgage rates remained elevated despite recent Fed rate cuts, with 30-year fixed rates holding near 6.39% as MBS pricing failed to improve meaningfully. The disconnect between Fed policy and mortgage rates continues to frustrate industry professionals, as bond market participants demand higher yields to compensate for inflation concerns.

Market makers report reduced liquidity in secondary markets, creating additional volatility for lenders managing pipeline risk. Industry experts emphasize the importance of lock-float considerations in today’s environment, with rate volatility creating complex decisions for borrowers and originators alike. The GNMA market showed similar weakness to conventional MBS, suggesting broad-based pressure across government-sponsored enterprise securities. Lock recommendations favor securing rates given the uncertain trajectory of bond pricing and potential for further yield increases. Economic data continues to support a “higher for longer” interest rate environment, with consumer spending resilience indicating persistent inflationary pressures.

Treasury markets reflect growing skepticism about the pace of future Fed rate cuts, with the 10-year note selling off in response to economic strength indicators. This dynamic creates headwinds for refinance activity while purchase money originations face affordability challenges. Secondary market conditions remain choppy as investors reassess duration risk in the current rate environment. Mortgage origination volumes continue to face pressure from reduced refinance opportunities and purchase market constraints. The industry awaits Friday’s PCE inflation data, which could provide further direction for both Treasury and MBS markets heading into the final quarter.

Subscribe to get this information in your inbox daily for free and stay ahead of mortgage market movements that impact your business decisions.