WTMS Blog Today = What’s up in Mortgage Today (10/01/2025)

Mortgage-backed securities (MBS) markets are showing cautious movement, with UMBS prices reflecting moderate pressure today. The UMBS 30-year securities saw a slight dip, signaling a modest setback in mortgage rates. GNMA-backed securities, by contrast, have experienced a small uptick, providing some relief to investors focused on government-backed mortgage instruments. The bond market is subtly influenced by ongoing investor sentiment, driven by broader economic uncertainty and Federal Reserve signals.

In the Treasury market, 10-year bond yields have edged lower for the third consecutive quarter, continuing a trend of decreased long-term borrowing costs. This decline is supportive for fixed mortgage rates but echoes a cautious mood across fixed-income markets. Concerns about inflation easing and expectations of the Federal Reserve pausing interest rate hikes are contributing factors. Despite these moves, the market remains vigilant for data that could alter the trajectory of yields. Recent commentary from market experts highlights the absence of immediate crisis fears in government bonds, yet conversations about potential risks persist among Wall Street analysts. The mortgage origination sector is adapting to these bond market shifts, with lenders monitoring pricing carefully to optimize rate locks and borrower offerings.

The general trend toward stable or slightly improved MBS prices supports some optimism within mortgage lenders. Real estate sales activity remains influenced by these financial market dynamics, as affordability plays a continuing role in homebuyer demand. Economic data releases scheduled this week will be closely watched for hints on inflation and employment, which indirectly shape mortgage rates via the bond markets. Investors and mortgage professionals are advised to track these indicators to anticipate market moves. In summary, mortgage-backed securities exhibit mixed but stable pricing trends today with UMBS under mild pressure and GNMA offering modest gains.

Treasury bonds yield declines support the potential for steadier mortgage rates moving forward, aligning with a broader economic backdrop expecting limited Fed action in the immediate term. Lenders and investors should remain attentive to economic data and Fed commentary as key drivers for future market volatility and opportunities.

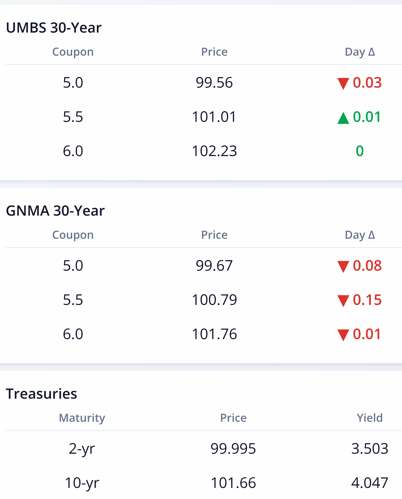

Real-Time Pricing

UMBS 30-Year:

– 5.0: Price 99.47, Day Δ -0.07

– 5.5: Price 101.05, Day Δ -0.02

– 6.0: Price 102.30, Day Δ +0.03

GNMA 30-Year:

– 5.0: Price 99.72, Day Δ +0.14

– 5.5: Price 100.91, Day Δ +0.09

– 6.0: Price 101.79, Day Δ +0.03

Treasuries:

– 2-yr: Price 100.094, Yield 3.576

– 5-yr: Price 99.743, Yield 3.682

– 10-yr: Price 100.996, Yield 4.127

Subscribe to get this critical market update delivered daily to your inbox, free.