WTMS Blog Today = What’s up in Mortgage Today (AM) – 10/09/2025

Bond markets opened with modest weakness this Thursday morning as the government shutdown continues to create data gaps. With jobless claims on hold due to the partial shutdown, traders are left without key economic indicators to guide direction. This creates an information vacuum that typically leads to sideways trading patterns until clearer signals emerge.

The mortgage-backed securities market reflects this uncertainty with UMBS 5.0 coupons down 19 basis points from yesterday’s close. Ten-year Treasury yields climbed 23 basis points to 4.141%, staying within the established 4.08% to 4.20% trading range that has defined recent market action. Fed Chair Powell is scheduled to speak today, though his remarks are pre-recorded and won’t address current monetary policy.

Legal challenges are emerging in the mortgage technology sector as Optimal Blue faces a class-action lawsuit alleging price collusion through its pricing analytics platform. The suit claims lenders using the service had spreads 2.68 basis points higher than competitors, though the highly competitive nature of mortgage banking raises questions about these allegations. Multiple major lenders including United Wholesale Mortgage and Rate are proactively raising conforming loan limits to $819,000, anticipating FHFA’s official 2026 announcement.

The September FOMC minutes released yesterday showed Fed officials remain divided on the pace of future rate cuts. Most participants supported the 25-basis-point reduction at their last meeting, though some argued for holding rates steady due to persistent inflation concerns. The minutes revealed that tariff-driven inflation has been less severe than initially feared, providing some relief for policymakers weighing their next moves.

Locking vs Floating

Risk and reward considerations remain muted during the ongoing government shutdown period. Risk-tolerant borrowers are waiting to see when the delayed jobs report will be released, provided bonds don’t lose significant ground in the meantime. MBS prices continue to help with intraday risk management, while 10-year yield ceiling and floor levels provide guidance for tracking broader bond market momentum.

Today’s Events

No economic data releases are scheduled due to the government shutdown. The day’s only potentially significant market-moving event is the 1:00 PM 30-year Treasury bond auction.

Bond Pricing

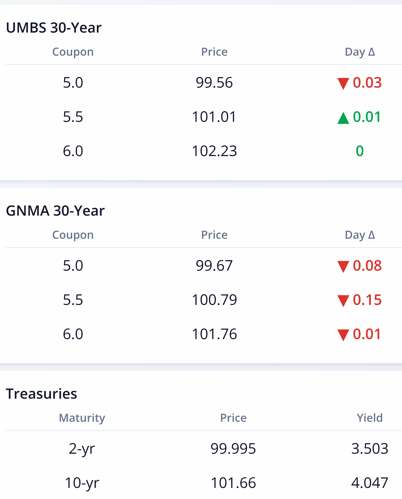

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.28 | -0.18 |

| 5.5 | 100.88 | -0.13 |

| 6.0 | 102.2 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.48 | -0.17 |

| 5.5 | 100.84 | 0.01 |

| 6.0 | 101.69 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.598 | 99.813 | 0.016 |

| 3 yr | 3.614 | 99.327 | 0.017 |

| 5 yr | 3.738 | 99.49 | 0.02 |

| 7 yr | 3.924 | 99.703 | 0.021 |

| 10 yr | 4.141 | 100.887 | 0.023 |

| 30 yr | 4.726 | 100.381 | 0.016 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.