WTMS Blog Today = What’s up in Mortgage Today (AM) – 10/10/2025

Japanese political turmoil is driving bond gains as Japan’s ruling coalition collapsed overnight. This reduced fears that Japan’s central bank would need to sell U.S. Treasuries, causing yields to drop sharply.

Fed Governor Waller’s dovish comments about weak employment and the need for more rate cuts added fuel to the rally. Markets recovered all of yesterday’s losses with mortgage bonds posting strong gains. The 10-year Treasury yield fell from 4.14% to 4.06% during active trading hours.

UMBS securities climbed 10+ ticks across most coupons, marking one of the better days for pricing this month. Fed Chair candidates have been narrowed to five names, including current Fed officials Michelle Bowman and Christopher Waller. Treasury Secretary Bessent conducted extensive interviews lasting up to two hours each.

The final selection process could extend past Thanksgiving due to international travel schedules. Mortgage credit availability increased in September to its highest level in four months. The Mortgage Bankers Association reported growing ARM loan offerings with broader eligibility requirements.

ARM rates remain about 80 basis points below fixed-rate loans, making them increasingly attractive as Fed cuts continue.

Locking vs Floating

Risk-reward remains muted during the government shutdown as economic data releases are suspended. Risk-tolerant borrowers are waiting for the delayed jobs report once government operations resume.

Today’s solid rate sheets provide an opportunity to lock gains, though bonds could drift through the session without major moves expected.

Today’s Events

No major economic data due to ongoing government shutdown. Consumer Sentiment preliminary reading at 10:00 AM expected to show 54.2 vs prior 55.1.

Fed officials Goolsbee and Musalem scheduled to speak later today.

Bond Pricing

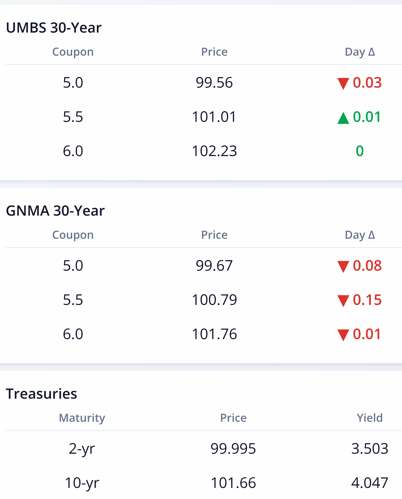

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.47 | 0.3 |

| 5.5 | 100.98 | 0.24 |

| 6.0 | 102.21 | 0.08 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.51 | -0.01 |

| 5.5 | 100.82 | 0.1 |

| 6.0 | 101.73 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.529 | 99.945 | -0.067 |

| 3 yr | 3.539 | 99.536 | -0.071 |

| 5 yr | 3.657 | 99.855 | -0.077 |

| 7 yr | 3.84 | 100.213 | -0.081 |

| 10 yr | 4.062 | 101.533 | -0.078 |

| 30 yr | 4.647 | 101.666 | -0.076 |