WTMS Blog Today = What’s up in Mortgage Today (AM) – 10/15/2025

Markets are winning across the board today as positive earnings reports soothe lingering trade war fears. The UMBS 5.0 coupon sits at 99.75, up 8 basis points this morning, while the 10-year Treasury dropped to 4.011%. This combination suggests mortgage rates could improve slightly by afternoon pricing.

Strong bank earnings are driving today’s rally, with Bank of America climbing over 5% after beating estimates. Fed Chair Powell’s comments yesterday about labor market weakness continue supporting rate cut expectations for October. The government shutdown enters its third week, but markets appear focused on corporate fundamentals rather than Washington dysfunction.

Locking vs Floating

Current market conditions present a measured risk environment for rate decisions. With bonds holding last week’s volatile gains, the risk-reward balance remains muted as we progress through the week. Given rates are at multi-week lows, risk-averse clients should maintain their lock positions while more aggressive borrowers wait for additional negative volatility to emerge.

Today’s Events

– NY Fed Manufacturing: 10.7 vs -1.0 forecast, -8.7 previous

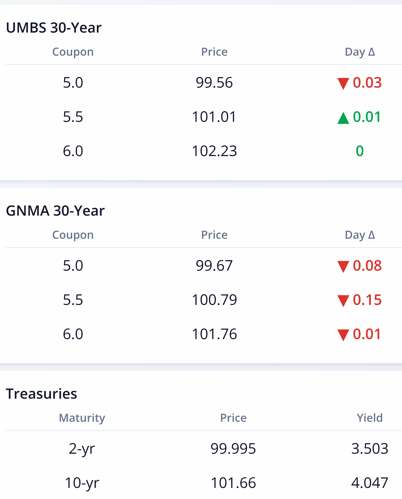

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.75 | 0.08 |

| 5.5 | 101.14 | 0.05 |

| 6.0 | 102.27 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.91 | 0.08 |

| 5.5 | 100.95 | 0.06 |

| 6.0 | 101.95 | -0.01 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.49 | 100.019 | 0.008 |

| 3 yr | 3.493 | 99.666 | 0.004 |

| 5 yr | 3.606 | 100.086 | -0.002 |

| 7 yr | 3.787 | 100.536 | -0.012 |

| 10 yr | 4.011 | 101.954 | -0.018 |

| 30 yr | 4.597 | 102.482 | -0.033 |