WTMS Blog Today = What’s up in Mortgage Today (AM) – 01/06/2026

Volume returns but volatility remains locked in a tight range as bond markets exit holiday mode. UMBS 5.0 coupons dropped 9 basis points to 99.72 while 10-year Treasury yields climbed to 4.189%. Defense spending comments triggered the weakest levels of the day around 10:37 AM.

This sideways trading pattern has persisted since December 10th, with all movement contained within a 4.10-4.20% range on 10-year yields. December’s S&P Global Services and Composite PMI data came in slightly below expectations this morning. The Services PMI hit 52.5 versus the 52.9 forecast, while Composite PMI registered 52.7 against a 53.0 estimate.

These readings signal continued expansion but at a slower pace than anticipated. Wednesday and Friday’s economic releases will likely determine if meaningful volatility finally returns to the mortgage market. Manufacturing data showed continued contraction yesterday, with factories shrinking for 10 straight months.

The labor market remains the key swing factor for Federal Reserve policy decisions ahead. Trump Administration policies are being evaluated for housing affordability impacts. Key proposals include potentially reversing recent conforming loan limit increases and resisting GSE capital requirement hikes for independent mortgage banks.

The administration also seeks to re-engage Federal Home Loan Banks as liquidity backstops for mortgage originators.

Locking vs Floating

Bond markets have exited holiday trading patterns, with yields returning exactly where they ended December 11th post-Fed day. The three weeks of meaningless volatility appear over, but meaningful movement depends on upcoming economic data.

Wednesday and Friday releases could finally break the current 4.10-4.20% yield range that has contained all trading since mid-December.

Today’s Events

– S&P Global Composite PMI (Dec): 52.7 vs 53.0 forecast, 54.2 previous

– S&P Global Services PMI (Dec): 52.5 vs 52.9 forecast, 54.1 previous

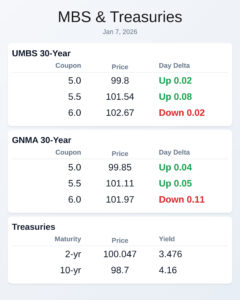

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.72 | -0.09 |

| 5.5 | 101.41 | -0.08 |

| 6.0 | 102.68 | -0.04 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.74 | -0.1 |

| 5.5 | 101.03 | -0.06 |

| 6.0 | 101.94 | -0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.479 | 100.041 | 0.027 |

| 3 yr | 3.546 | 99.87 | 0.027 |

| 5 yr | 3.732 | 99.518 | 0.027 |

| 7 yr | 3.949 | 98.796 | 0.025 |

| 10 yr | 4.189 | 98.47 | 0.026 |

| 30 yr | 4.875 | 96.084 | 0.033 |