WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/03/2026

Housing market headwinds intensified in December as more than 40,000 signed purchase agreements were canceled. This 16.3% cancellation rate marks a sharp increase from 14.9% the previous December, signaling buyer selectivity in today’s challenging market. Home sellers now outnumber buyers by a record margin, giving remaining buyers more options and negotiating power.

Manufacturing showed surprising strength in January despite broader economic concerns. The ISM Manufacturing Index jumped to 52.6, marking the first expansion reading after 26 consecutive months of contraction. New orders surged dramatically, though employment remains in contraction territory as companies continue managing headcount carefully.

Government shutdown chaos disrupted key economic data releases that mortgage originators rely on for rate direction. Friday’s critical jobs report has been postponed indefinitely, with the Bureau of Labor Statistics confirming no release until government funding resumes. The Senate passed a funding measure, but House disagreements over ICE policies and voter ID requirements continue blocking resolution.

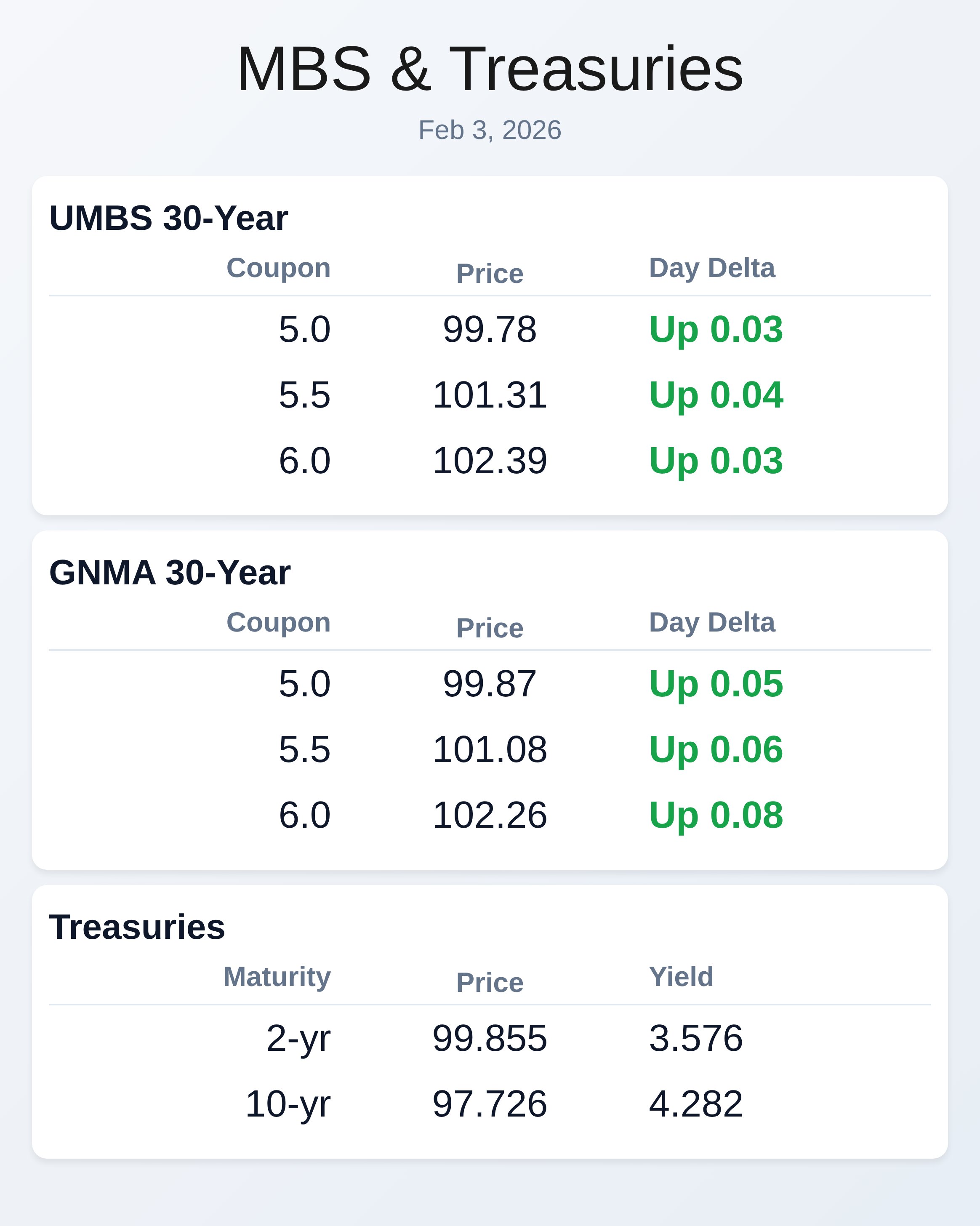

MBS markets showed modest resilience despite Treasury weakness this morning. UMBS securities gained 3-4 ticks while the 10-year Treasury yield climbed to 4.282%. This outperformance suggests mortgage-backed securities may provide better relative value as economic uncertainty persists.

Locking vs Floating

Economic data surprises like today’s strong ISM Manufacturing reading can trigger immediate rate volatility. With major reports delayed due to the shutdown, Wednesday’s ISM Services and ADP data become critical market movers. Current sideways Treasury movement suggests cautious floating for longer-term locks, but near-term closings should consider protection given data uncertainty.

Today’s Events

ISM Manufacturing Employment (Jan): 48.1 vs 44.9 previous

ISM Manufacturing PMI (Jan): 52.6 vs 48.5 forecast, 47.9 previous

ISM Manufacturing Prices Paid (Jan): 59.0 vs 60.5 forecast, 58.5 previous

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.78 | 0.03 |

| 5.5 | 101.31 | 0.04 |

| 6.0 | 102.39 | 0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.87 | 0.05 |

| 5.5 | 101.08 | 0.06 |

| 6.0 | 102.26 | 0.08 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.576 | 99.855 | 0 |

| 3 yr | 3.651 | 99.574 | 0.006 |

| 5 yr | 3.843 | 99.582 | 0.004 |

| 7 yr | 4.058 | 99.648 | 0.002 |

| 10 yr | 4.282 | 97.726 | 0.001 |

| 30 yr | 4.913 | 95.5 | 0.002 |