WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/04/2026

Government shutdown drama finally ends as the House reached a deal to reopen federal operations, heading to Trump’s desk for signature today. The Bureau of Labor Statistics has already delayed Friday’s jobs report, but officials hope overall economic disruption remains minimal this time around. Yesterday’s JOLTS job openings report was also postponed due to the shutdown.

The funding deal covers most government operations through the fiscal year, but the Department of Homeland Security only received two more weeks of funding. Democrats are pushing for additional immigration enforcement guardrails, setting up continued negotiations on this contentious issue. January’s job market showed continued cooling with ADP reporting just 22,000 new private sector positions, well below the 48,000 forecast.

This marks a dramatic slowdown from 2024’s pace, with private employers adding only 398,000 jobs in 2025 compared to 771,000 the previous year. Dr. Nela Richardson, ADP’s chief economist, noted that while job creation has slowed consistently for three years, wage growth has remained stable.

The employment picture revealed mixed signals across sectors, with education and health services adding 74,000 jobs while professional and business services shed 57,000 positions. Compensation growth continues moderating, with job stayers seeing 4.5% increases while job changers experienced a decline from 6.6% to 6.4%. Mortgage applications plunged 9% last week as Winter Storm Fern hammered much of the country, with purchase applications falling 14% and refinances dropping 5%.

The 30-year fixed rate averaged 6.21%, a slight decline that wasn’t significant enough to motivate more borrowers to refinance. The annual increase in purchase applications hit its weakest level since April 2025. Private credit markets are showing stress that mortgage professionals should monitor closely, with stocks like Blue Owl, KKR, TPG, and Apollo getting crushed recently.

BlackRock TCP Capital Fund took a 19% writedown to net asset value last week, and many of these funds carry significant software company exposure. While not directly affecting mortgages, credit crises tend to spread, with non-QM lending being the most vulnerable area given flattening real estate prices and declining rents. SOFR swap rates are now included in expanded market data, providing transparent long-term rate views through Eris SOFR Swap futures.

These instruments offer capital efficiency advantages over cash bonds and precision hedging capabilities across the 30-year curve. They’re becoming the preferred choice for hedging MSR portfolios, ARMs, non-QM, and Agency mortgage key rate duration.

Locking vs Floating

Today’s economic data failed to inspire major market movements, with ADP employment showing minimal bond reaction and weaker ISM Services providing only slight rallies.

The 10-year Treasury yield moved from 4.29% down to 4.272% following ISM data, while MBS remain down 2 ticks on the day. With key economic reports delayed due to the government shutdown, markets are waiting for clearer directional signals.

Today’s Events

ADP Employment: 22k vs 48k forecast, 41k previous

ISM Business Activity (Jan): 57.4 vs 56.0 previous

ISM Non-Manufacturing PMI (Jan): 53.8 vs 53.5 forecast, 54.4 previous

ISM Services Employment (Jan): 50.3 vs 52.3 forecast, 52.0 previous

ISM Services New Orders (Jan): 53.1 vs 57.9 previous

ISM Services Prices (Jan): 66.6 vs 64.3 previous

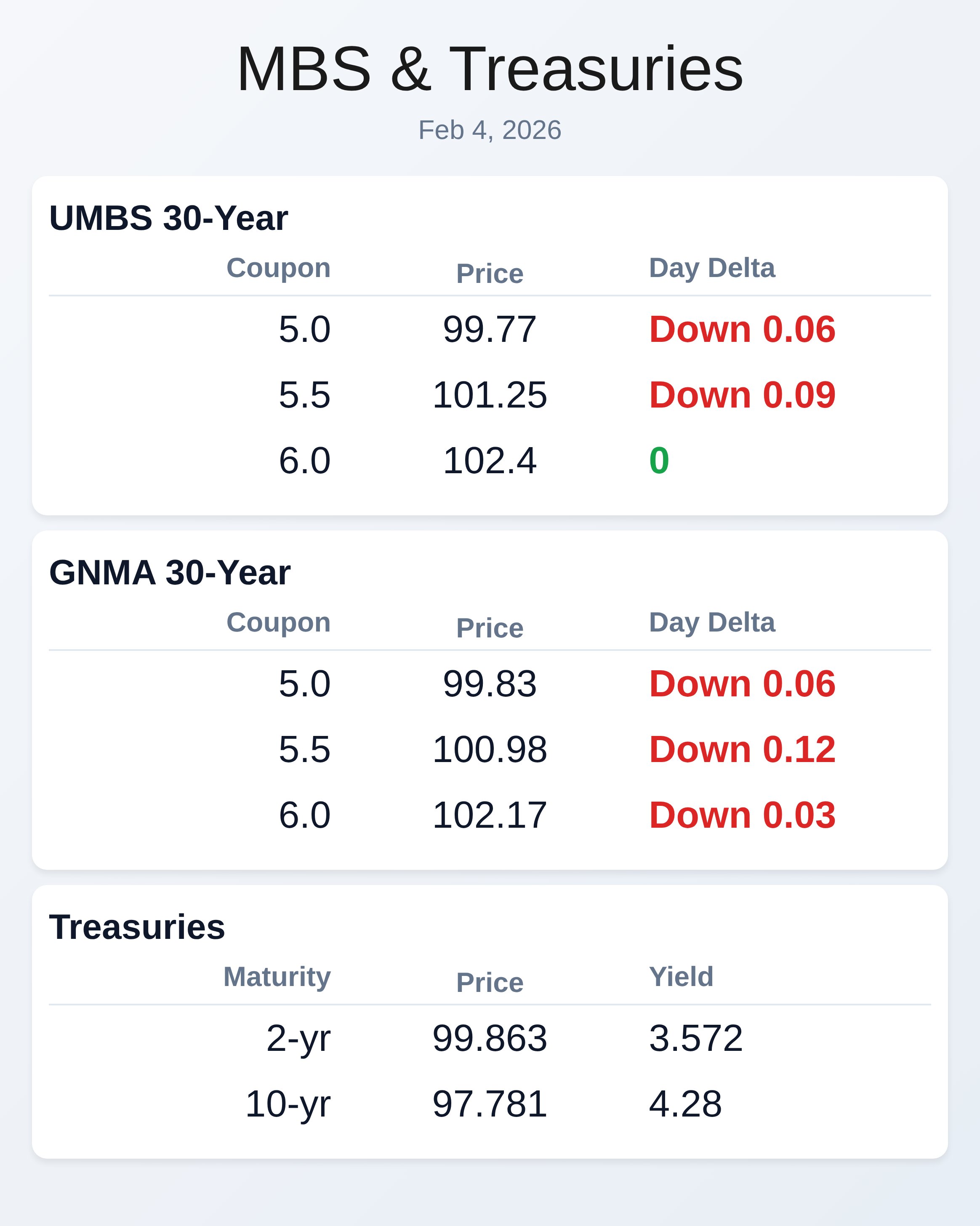

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.77 | -0.06 |

| 5.5 | 101.25 | -0.09 |

| 6.0 | 102.4 | 0 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.83 | -0.06 |

| 5.5 | 100.98 | -0.12 |

| 6.0 | 102.17 | -0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.572 | 99.863 | 0.002 |

| 3 yr | 3.649 | 99.586 | 0.003 |

| 5 yr | 3.84 | 99.594 | 0.003 |

| 7 yr | 4.056 | 99.664 | 0.006 |

| 10 yr | 4.28 | 97.781 | 0.007 |

| 30 yr | 4.912 | 95.531 | 0.006 |