WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/06/2026

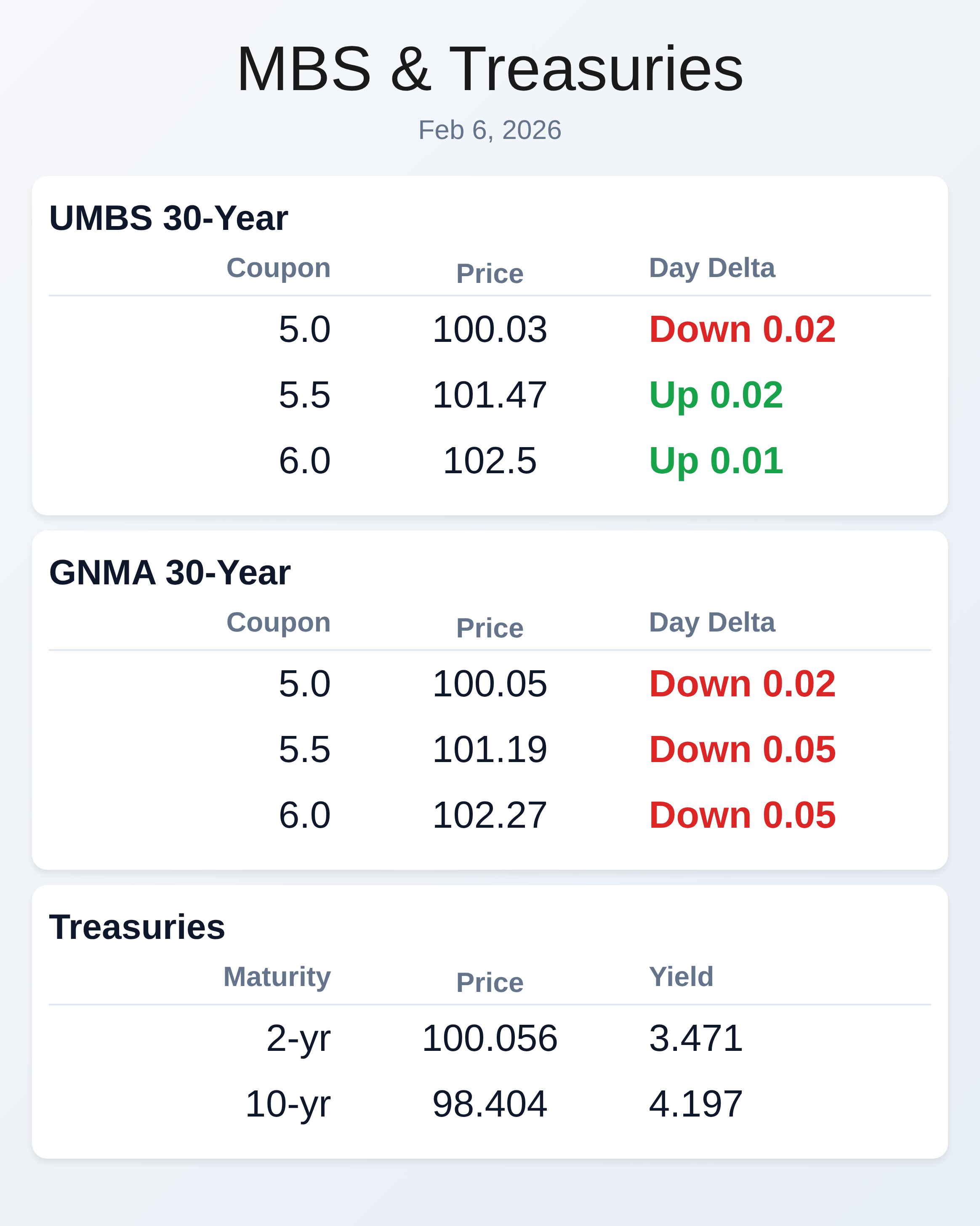

Markets are experiencing a surprisingly strong bond rally despite mixed economic signals. The 10-year Treasury yield sits at 4.197%, up just 1.7 basis points overnight in what traders are calling modest weakness. MBS pricing shows mixed performance with UMBS 5.5 coupons gaining 2 ticks while GNMA securities posted small declines across most coupons.

Thursday’s labor market data created significant bond market momentum that’s carrying into today’s session. The absence of major economic releases this week puts all eyes on next Wednesday’s jobs report as the key catalyst for direction. This creates an interesting tactical environment where short-term positioning matters more than usual.

GNMA 30-year securities are showing relative weakness compared to UMBS, with the 5.5 and 6.0 coupons down 5 basis points each. This spread between agency securities often signals institutional flow patterns that can predict rate sheet adjustments. Lenders watching these differentials may adjust pricing strategies accordingly.

The Treasury curve shows uniform weakness with yields rising between 1.2 and 2.3 basis points across all maturities. The 3-year note leads the selloff at 2.3 basis points higher, while the 30-year long bond shows the most resilience with only a 1.2 basis point increase. This flattening bias suggests caution about long-term economic growth prospects.

Locking vs Floating

Thursday’s employment data triggered serious bond market movement, setting up next Wednesday’s jobs report as the critical decision point. With no major economic releases remaining this week, markets are in a holding pattern that could break decisively in either direction. Borrowers floating with lenders who haven’t improved pricing today face less downside risk than normal heading into Friday’s session.

Today’s Events

No major economic data releases are scheduled for today.

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.03 | -0.02 |

| 5.5 | 101.47 | 0.02 |

| 6.0 | 102.5 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.05 | -0.02 |

| 5.5 | 101.19 | -0.05 |

| 6.0 | 102.27 | -0.05 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.471 | 100.056 | 0.012 |

| 3 yr | 3.543 | 99.88 | 0.023 |

| 5 yr | 3.736 | 100.064 | 0.019 |

| 7 yr | 3.959 | 100.248 | 0.02 |

| 10 yr | 4.197 | 98.404 | 0.017 |

| 30 yr | 4.854 | 96.4 | 0.012 |