WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/09/2026

The Trump Administration’s potential antitrust investigation into homebuilders sent housing stocks tumbling Friday, though the market concentration claims appear questionable. With D.R. Horton selling 85,000 homes and Lennar moving 82,000 units against a total market of 737,000 new home sales, the fragmentation suggests this move targets housing affordability pressure rather than true monopoly concerns.

Mortgage originators should watch this closely as any regulatory pressure on builders could impact new construction lending pipelines. Meanwhile, the House prepares to vote on bipartisan housing affordability measures including higher multifamily loan limits and enhanced construction loan support. These programs could create new origination opportunities for lenders positioned in the construction and rehab space.

Eight Senate Democrats are pushing back hard against the CFPB’s proposed elimination of disparate impact enforcement under the Equal Credit Opportunity Act. Led by Senators Warnock and Warren, they warn that removing this 50-year standard would enable discrimination and worsen housing affordability across mortgage, credit card, and auto lending. This regulatory uncertainty adds another compliance consideration for originators already navigating changing enforcement priorities.

Home equity positions show nearly 45% of mortgaged homeowners are equity-rich, owing less than half their home’s value as of Q4. However, this wealth concentration is slipping from its Q2 2024 peak of 49.2%, while seriously underwater properties ticked up to 3.0%. These trends impact refinance volumes and cash-out opportunities for mortgage professionals.

Consumer sentiment data released today shows improvement with February readings of 57.3 versus the 55 forecast, while inflation expectations declined to 3.5% for one-year and held steady at 3.4% for five-year outlooks. MBS markets are showing potential signs of GSE buying activity as mortgage-backed securities outperform treasuries.

Locking vs Floating

Thursday’s labor market data created serious bond movement, with next Wednesday’s jobs report positioned as the key catalyst to either confirm the recent breakout or signal a return to previous ranges.

Lenders who didn’t see positive repricing Friday afternoon may have a few ticks of protection heading into Monday’s rate sheets, though weekend geopolitical volatility presents elevated risk. The tactical overnight float opportunity that worked perfectly for some lenders continues on a smaller scale, but requires careful risk assessment given upcoming employment data.

Today’s Events

– Consumer Sentiment (Feb): 57.3 vs 55 forecast, 56.4 previous

– Sentiment: 1y Inflation (Feb): 3.5% vs 4% previous

– Sentiment: 5y Inflation (Feb): 3.4% vs 3.3% previous

– U Mich conditions (Feb): 58.3 vs 54.9 forecast, 55.4 previous

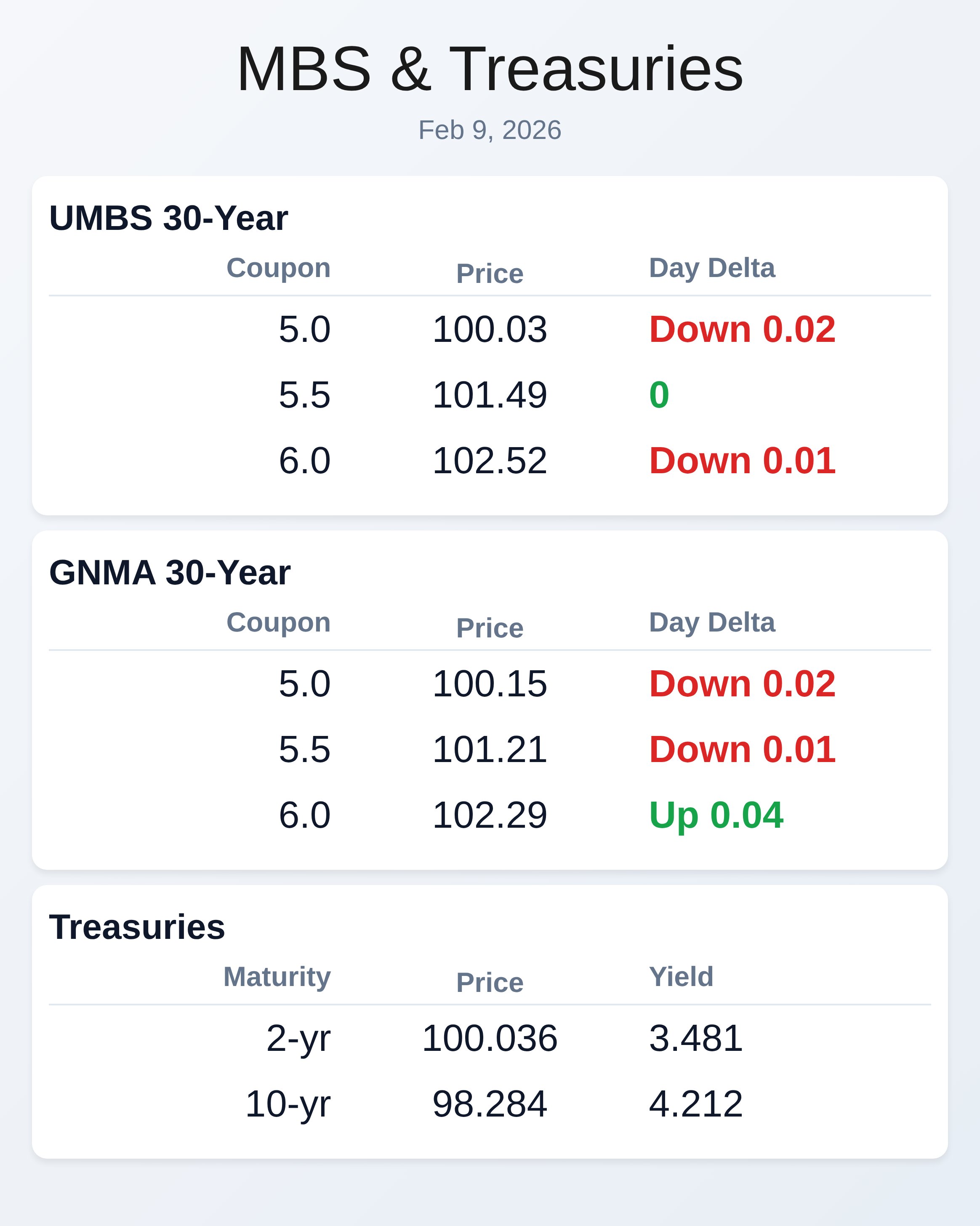

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.03 | -0.02 |

| 5.5 | 101.49 | 0 |

| 6.0 | 102.52 | -0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.15 | -0.02 |

| 5.5 | 101.21 | -0.01 |

| 6.0 | 102.29 | 0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.481 | 100.036 | -0.015 |

| 3 yr | 3.555 | 99.846 | -0.012 |

| 5 yr | 3.749 | 100.003 | -0.004 |

| 7 yr | 3.974 | 100.158 | 0.002 |

| 10 yr | 4.212 | 98.284 | 0.007 |

| 30 yr | 4.867 | 96.204 | 0.015 |