WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/10/2026

Mortgage markets are rallying after a volatile start, with bonds taking a pre-NFP lead-off as traders position ahead of Wednesday’s critical employment report. The 10-year Treasury yield dropped 5 basis points to 4.151% following weaker-than-expected economic data releases. GNMA securities are leading the recovery with impressive gains across all coupons, while UMBS pricing shows mixed performance.

Employment costs for Q4 came in lower than forecasted at 0.7% versus the expected 0.8%, providing relief to bond markets concerned about wage inflation. December retail sales disappointed completely, showing 0% growth against a 0.4% forecast, with the control group actually declining 0.1%. These softer economic readings suggest less inflationary pressure, which typically benefits mortgage-backed securities and could translate to better pricing for originators.

GNMA 30-year securities are the clear outperformers this morning, with the 6.0 coupon gaining 21 basis points and strong performance across the board. Treasury yields are declining across the entire curve, with the 30-year bond down 6.4 basis points to 4.796%. This yield environment creates favorable conditions for mortgage pricing improvements throughout the day.

The market’s attention now shifts to Wednesday’s jobs report, which represents the biggest potential volatility day for the week ahead. Some speculation exists that employment numbers may come in softer than expected, though analysts caution against reading too much into early commentary. The gradual overnight strength followed by additional post-data gains suggests positive technical momentum heading into the week’s main event.

Locking vs Floating

Wednesday’s jobs report will be the focal point for mortgage market volatility this week. Current market momentum favors floating for deals with flexible closing timelines, but originators should prepare for potential Wednesday volatility that could quickly reverse today’s gains. MBS pricing provides better intraday risk management, while Treasury yield levels help track broader bond market momentum.

Consider your pipeline’s risk tolerance when making lock decisions ahead of Wednesday’s employment data.

Today’s Events

– Employment costs Q4: 0.7% vs 0.8% forecast, 0.8% previous

– Import prices (Dec): 0.1% vs 0.1% forecast

– Retail Sales (Dec): 0% vs 0.4% forecast, 0.6% previous

– Retail Sales Control Group (Dec): -0.1% vs 0.4% forecast, 0.4% previous

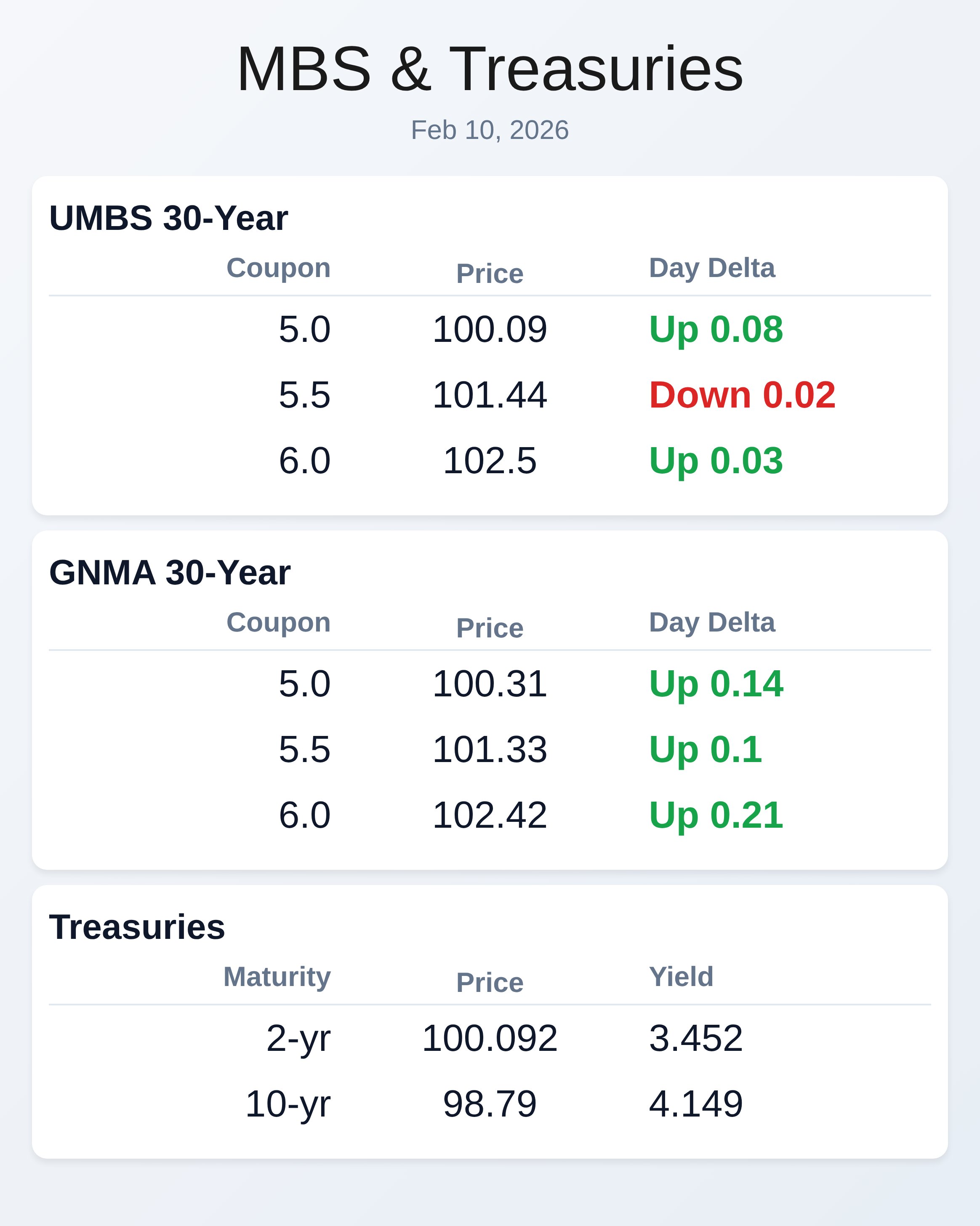

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.09 | 0.08 |

| 5.5 | 101.44 | -0.02 |

| 6.0 | 102.5 | 0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.31 | 0.14 |

| 5.5 | 101.33 | 0.1 |

| 6.0 | 102.42 | 0.21 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.452 | 100.092 | -0.034 |

| 3 yr | 3.518 | 99.95 | -0.039 |

| 5 yr | 3.698 | 100.235 | -0.045 |

| 7 yr | 3.914 | 100.523 | -0.05 |

| 10 yr | 4.149 | 98.79 | -0.058 |

| 30 yr | 4.796 | 97.301 | -0.064 |