WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/11/2026

Mortgage bonds are enjoying their best levels in weeks as traders brace for Friday’s Consumer Price Index report. The UMBS 5.5 coupon held steady at 101.32 while the 6.0 coupon gained slightly to 102.42. January’s employment data delivered mixed signals, with payrolls crushing forecasts at 130,000 new jobs versus the expected 70,000.

The unemployment rate dropped to 4.3% from December’s 4.4%, beating expectations of holding steady. Average earnings climbed 0.4% monthly, exceeding the 0.3% forecast and signaling persistent wage pressures. Labor force participation ticked up to 62.5%, suggesting more Americans are actively seeking work.

Treasury yields surged across the curve as bond markets absorbed the stronger-than-expected jobs data. The 10-year Treasury yield jumped 4.7 basis points to 4.191%, while shorter-term rates saw even larger increases. The 2-year yield spiked 6.8 basis points to 3.522%, reflecting expectations for potential Fed policy adjustments.

Locking vs Floating

Despite the stronger employment numbers, bond markets showed surprising resilience with only a modest sell-off. However, lopsided jobs reports tend to establish momentum patterns that can persist through subsequent trading sessions. Floating carries above-average risk given this dynamic, especially with Friday’s CPI data looming as the next major market catalyst.

Today’s Events

– Average earnings mm (Jan): 0.4% vs 0.3% forecast, 0.3% previous

– Non Farm Payrolls (Jan): 130K vs 70K forecast, 50K previous

– Participation Rate (Jan): 62.5% vs — forecast, 62.4% previous

– Unemployment rate mm (Jan): 4.3% vs 4.4% forecast, 4.4% previous

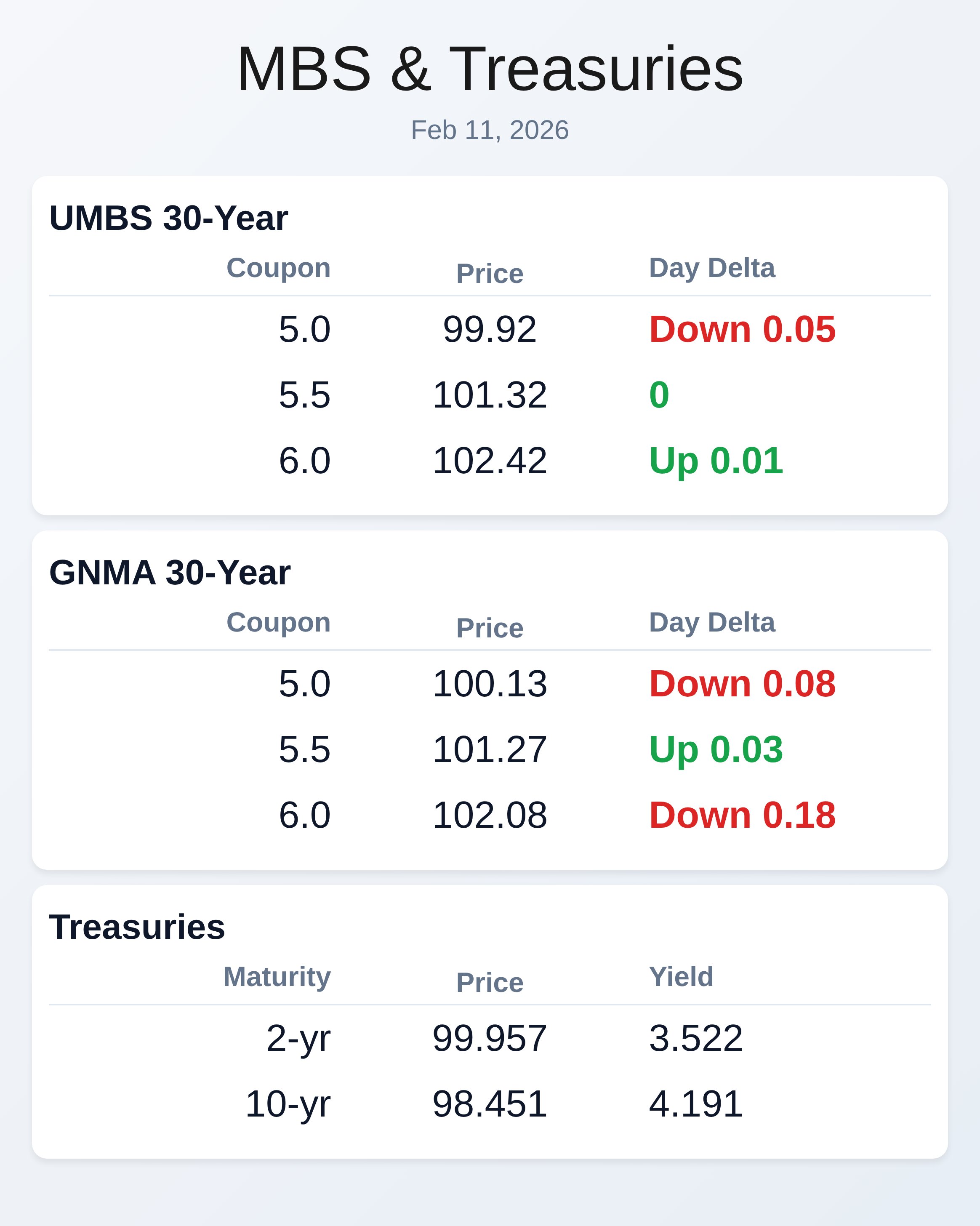

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.92 | -0.05 |

| 5.5 | 101.32 | 0 |

| 6.0 | 102.42 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.13 | -0.08 |

| 5.5 | 101.27 | 0.03 |

| 6.0 | 102.08 | -0.18 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.522 | 99.957 | 0.068 |

| 3 yr | 3.584 | 99.763 | 0.07 |

| 5 yr | 3.762 | 99.946 | 0.06 |

| 7 yr | 3.971 | 100.174 | 0.057 |

| 10 yr | 4.191 | 98.451 | 0.047 |

| 30 yr | 4.821 | 96.902 | 0.021 |