WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/12/2026

PennyMac just made mortgage industry history with its $172.5 million acquisition of Cenlar Capital Corp., the nation’s second-largest mortgage subservicer. This groundbreaking deal will add up to $740 billion in unpaid principal balance and 2 million loans to PennyMac’s portfolio, pushing their total servicing portfolio past the $1 trillion mark. For mortgage originators, this consolidation signals a maturing industry where scale and efficiency are becoming critical competitive advantages.

The job market delivered mixed signals in January with 130,000 new jobs added, but here’s the concerning detail: healthcare and social assistance accounted for 95% of all job growth. Outside of healthcare, job creation has been essentially flat since December 2024, raising questions about broader economic momentum. Unemployment did drop to 4.3%, though this masks growing disparities in the economy.

Corporate credit spreads hit remarkable lows in January, with investment-grade bonds reaching 27-year tights and junk bonds at 18-year lows. This flood of capital is particularly benefiting the non-QM space, where lenders report daily inquiries from new DSCR wholesalers seeking paper. Despite regional challenges in Baltimore, Philadelphia, and Florida, MBS spreads remain historically normal, suggesting room for further tightening.

Consumer sentiment rose to 57.3 in February’s preliminary University of Michigan survey, a six-month high that still remains below recession-level thresholds dating back to 1953. The wealth gap continues widening, with high-income earners showing confidence at 66.5 while lower-income sentiment fell to 48.9. This K-shaped recovery pattern directly impacts mortgage demand across different price segments.

Kansas City Fed President Jeff Schmid delivered hawkish commentary yesterday, emphasizing that with inflation running closer to 3% than the Fed’s 2% target, monetary policy should remain restrictive. He noted that productivity growth in Q3 2025 exceeded any quarter from 2010-2019, but cautioned that current economic momentum shows little evidence of constraint from interest rates. Friday’s CPI report will be crucial for determining the Fed’s next moves.

Locking vs Floating

Wednesday’s surprisingly muted bond reaction to strong jobs data created a deceptive calm in markets. However, lopsided employment reports typically establish momentum patterns that make floating riskier than usual. With Friday’s CPI release approaching as the next major catalyst, originators should exercise extra caution with rate locks this week.

Today’s Events

– Continued Claims (Jan 31): 1,862K vs 1,850K forecast, 1,844K previous

– Jobless Claims (Feb 7): 227K vs 222K forecast, 231K previous

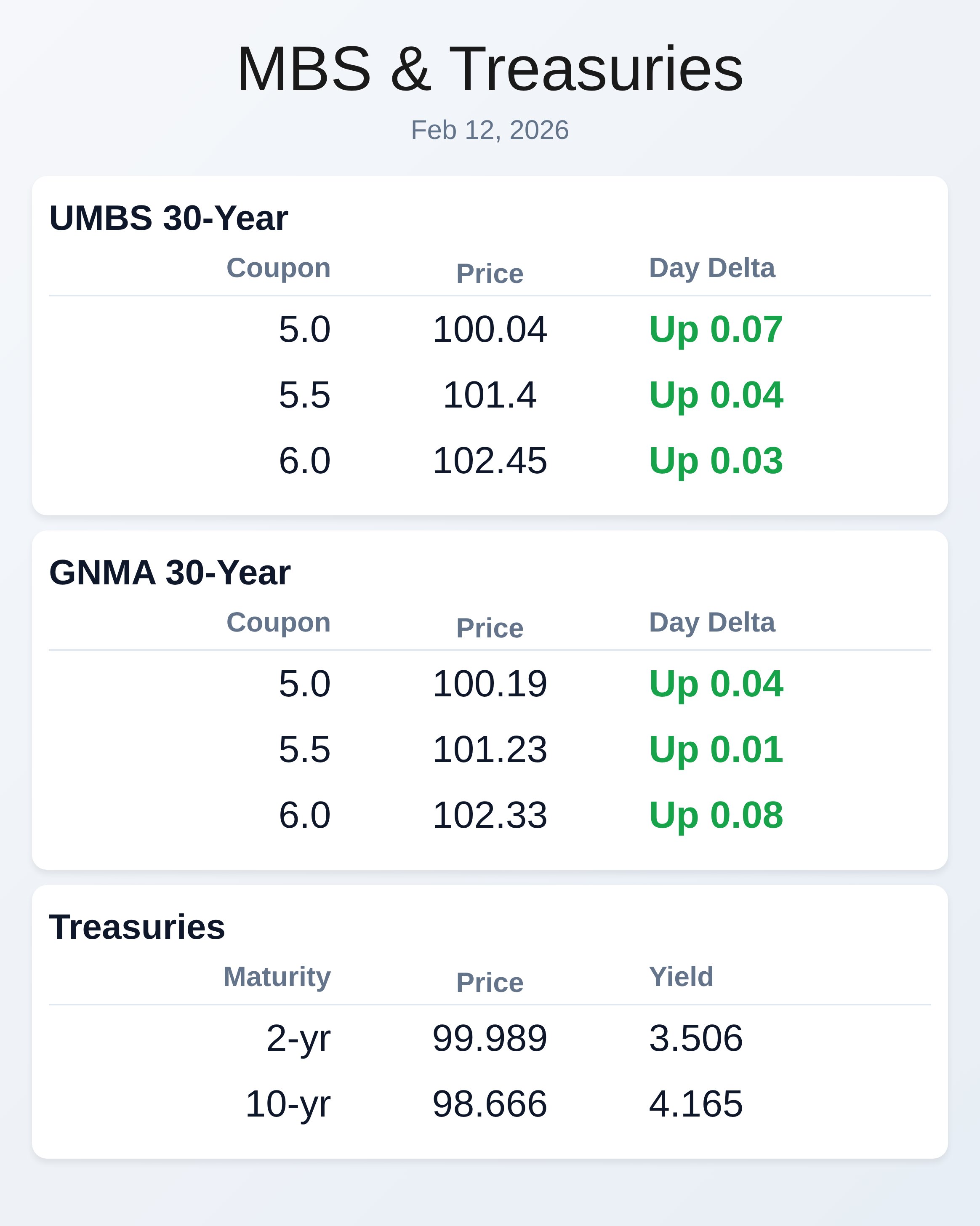

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.04 | 0.07 |

| 5.5 | 101.4 | 0.04 |

| 6.0 | 102.45 | 0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.19 | 0.04 |

| 5.5 | 101.23 | 0.01 |

| 6.0 | 102.33 | 0.08 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.506 | 99.989 | -0.006 |

| 3 yr | 3.561 | 99.828 | -0.009 |

| 5 yr | 3.73 | 100.091 | -0.013 |

| 7 yr | 3.935 | 100.397 | -0.016 |

| 10 yr | 4.165 | 98.666 | -0.007 |

| 30 yr | 4.792 | 97.365 | -0.019 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.