WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/13/2026

Bond markets experienced a magical and mysterious rally that drove yields to their lowest levels in two months. The 10-year Treasury yield dropped 35 basis points while UMBS coupons posted solid gains across all coupon ranges. This surprising movement caught many traders off guard as inflation data loomed large on today’s economic calendar.

The January CPI report delivered mixed results that ultimately favored bond prices. Core CPI matched forecasts at 0.3% monthly but headline CPI came in below expectations at 0.2% versus the 0.3% forecast. Year-over-year core inflation held steady at 2.5% while headline inflation dropped to 2.4%, both providing relief to markets concerned about persistent price pressures.

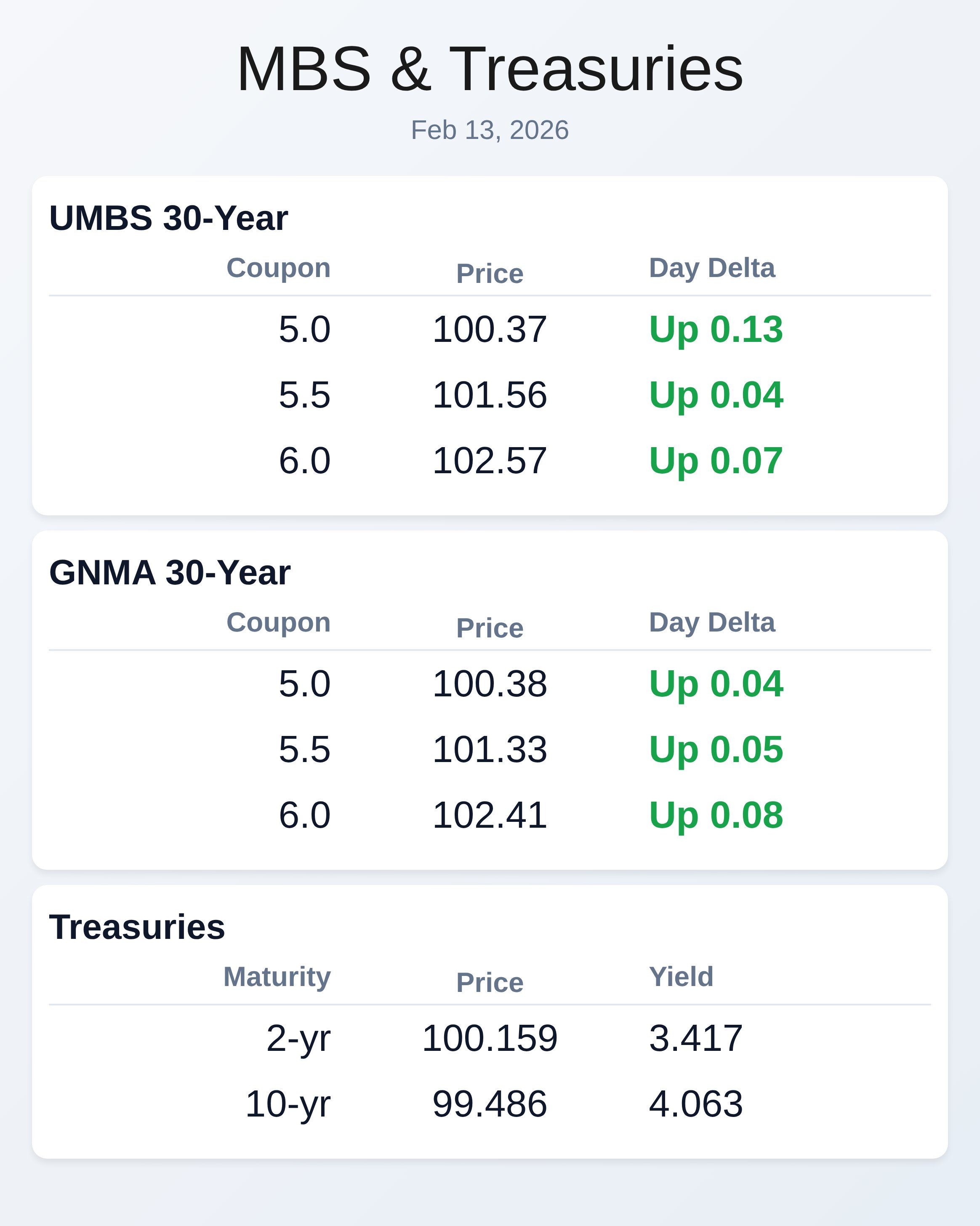

UMBS 30-year securities benefited from the bond rally with the 5.0 coupon gaining 13 basis points to reach 100.37. The 6.0 coupon advanced 7 basis points to 102.57, while the popular 5.5 coupon added 4 basis points to close at 101.56. GNMA securities posted similar gains with consistent strength across all coupon levels.

Treasury yields fell sharply across the entire yield curve with the 10-year note dropping to 4.063% from higher levels. The 30-year bond yield declined 38 basis points to 4.699%, while shorter-term notes like the 2-year fell 36 basis points to 3.417%. This broad-based rally suggests institutional investors are repositioning for potentially less aggressive Federal Reserve policy.

Locking vs Floating

Thursday’s paradoxical bond rally has left many market participants questioning whether this momentum can sustain itself. Risk-tolerant borrowers may want to wait for the market to demonstrate staying power before making locking decisions. Risk-averse clients should consider the volatility potential that often accompanies major CPI releases and economic data surprises.

Today’s Events

m/m CORE CPI (Jan)

– 0.3% vs 0.3% f’cast, 0.2% prev

m/m Headline CPI (Jan)

– 0.2% vs 0.3% f’cast, 0.3% prev

y/y CORE CPI (Jan)

– 2.5% vs 2.5% f’cast, 2.6% prev

y/y Headline CPI (Jan)

– 2.4% vs 2.5% f’cast, 2.7% prev

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.37 | 0.13 |

| 5.5 | 101.56 | 0.04 |

| 6.0 | 102.57 | 0.07 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.38 | 0.04 |

| 5.5 | 101.33 | 0.05 |

| 6.0 | 102.41 | 0.08 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.417 | 100.159 | -0.036 |

| 3 yr | 3.458 | 100.118 | -0.042 |

| 5 yr | 3.619 | 100.597 | -0.037 |

| 7 yr | 3.824 | 101.07 | -0.037 |

| 10 yr | 4.063 | 99.486 | -0.035 |

| 30 yr | 4.699 | 98.813 | -0.038 |