WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/18/2026

Mortgage markets are starting this holiday-shortened week on relatively calm footing despite modest weakness in bond prices. The 10-year Treasury yield edged up half a basis point to 4.064%, while UMBS pricing held mostly steady with mixed movements across coupons. Markets showed little reaction to this morning’s economic data releases, suggesting traders are waiting for bigger catalysts.

Housing starts data provided a bright spot for the mortgage industry, coming in significantly stronger than expected at 1.404 million units versus the 1.33 million forecast. The MBA refinance index also jumped to 1375.9 from 1284.6 previously, indicating continued homeowner interest in rate optimization. However, the purchase index dipped slightly to 157.1 from 161.5, reflecting ongoing affordability challenges.

Durable goods orders offered mixed signals, with the headline figure declining 1.4% but performing better than the expected 2% drop. Core durable goods, which excludes transportation, rose 0.6% versus the 0.4% forecast. These manufacturing indicators provide context for Federal Reserve policy discussions moving forward.

GNMA securities outperformed UMBS counterparts across most coupons today, with the 5.0 and 5.5 coupons both gaining 18 basis points. This performance differential highlights varying investor appetite between government-guaranteed and conventional mortgage securities. Treasury yields remained elevated across the curve, with the 30-year bond yielding 4.702%.

Locking vs Floating

The bond market appears to be encountering resistance as 10-year yields approach the psychological 4.0% level, creating headwinds for further rate improvements. Risk-averse clients should maintain a lock-biased approach given this technical resistance and the lack of follow-through from last week’s rally. Risk-tolerant clients haven’t seen enough of a pullback to trigger even conservative lock strategies, but the current environment favors caution over speculation.

Today’s Events

– MBA Purchase Index (Feb 13): 157.1 vs 161.5 previous

– MBA Refi Index (Feb 13): 1375.9 vs 1284.6 previous

– Core Durable Goods (Dec): 0.6% vs 0.4% forecast, 0.7% previous

– Durable Goods (Dec): -1.4% vs -2% forecast, 5.3% previous

– Housing Starts (Dec): 1.404M vs 1.33M forecast

– Housing Starts (Nov): 1.322M vs 1.246M previous

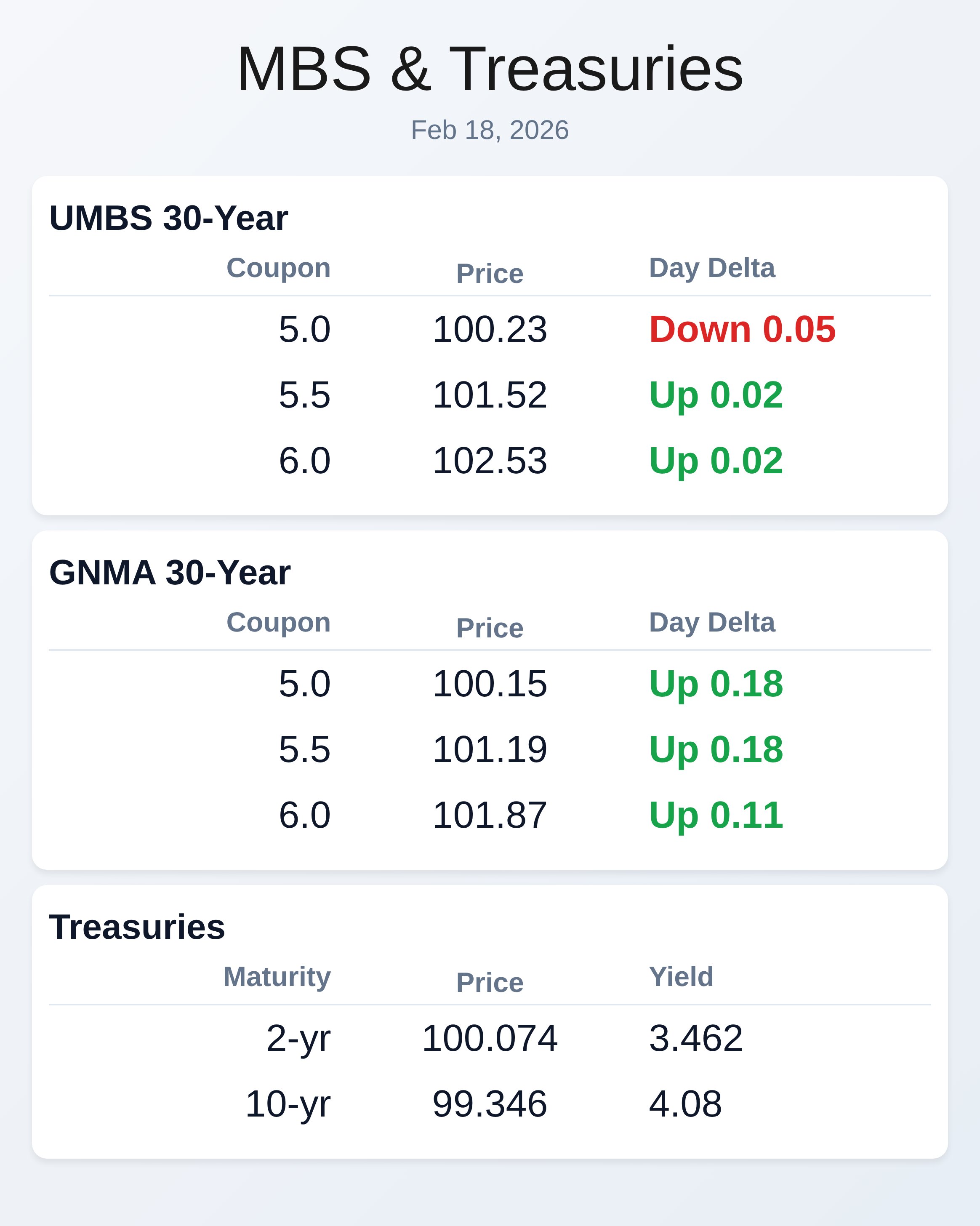

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.23 | -0.05 |

| 5.5 | 101.52 | 0.02 |

| 6.0 | 102.53 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.15 | 0.18 |

| 5.5 | 101.19 | 0.18 |

| 6.0 | 101.87 | 0.11 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.462 | 100.074 | 0.027 |

| 3 yr | 3.496 | 100.01 | 0.03 |

| 5 yr | 3.651 | 100.447 | 0.029 |

| 7 yr | 3.85 | 100.914 | 0.025 |

| 10 yr | 4.08 | 99.346 | 0.021 |

| 30 yr | 4.702 | 98.767 | 0.012 |