WTMS Blog Today = What’s up in Mortgage Today (AM) – 02/19/2026

Mortgage markets opened weaker this morning with little reaction to surprisingly positive economic data. The UMBS 5.0 coupon dropped 4 basis points while 10-year Treasury yields climbed 2.5 basis points to 4.102%. This early morning weakness suggests underlying technical resistance at the critical 4% level that mortgage originators should watch closely.

Jobless Claims came in at 206,000, significantly better than the 225,000 forecast and previous week’s 227,000 reading. The Philadelphia Fed Business Index also surprised to the upside at 16.3 versus expectations of 8.5. Despite these strong economic indicators, bond markets failed to react positively, indicating broader technical concerns are weighing on sentiment.

The lack of market response to good economic news is telling mortgage professionals that technical factors may be overriding fundamental data. Ten-year yields are facing resistance at the 4% mark, and historically, bonds have been limited to 25 basis point rallies with corrections following each attempt since July 2025. This pattern suggests mortgage rates may struggle to improve significantly in the near term.

GNMA securities showed mixed performance with the 5.5 coupon actually gaining 2 basis points while other coupons declined. This divergence in GNMA pricing compared to UMBS indicates varying investor appetite across different security types. For originators, this could mean slightly better execution on certain loan products depending on your outlet’s preferences.

Locking vs Floating

Market technicals suggest a defensive approach given bonds’ failure to build on last week’s gains. The 4% resistance level in 10-year yields appears to be holding firm, creating an environment where further rate improvements seem limited. While economic data over the next two days could provide surprises, the current setup favors caution over optimism for rate improvements.

Today’s Events

– Jobless Claims (Feb 14): 206K vs 225K forecast, 227K previous

– Philly Fed Business Index (Feb): 16.3 vs 8.5 forecast, 12.6 previous

Bond Pricing

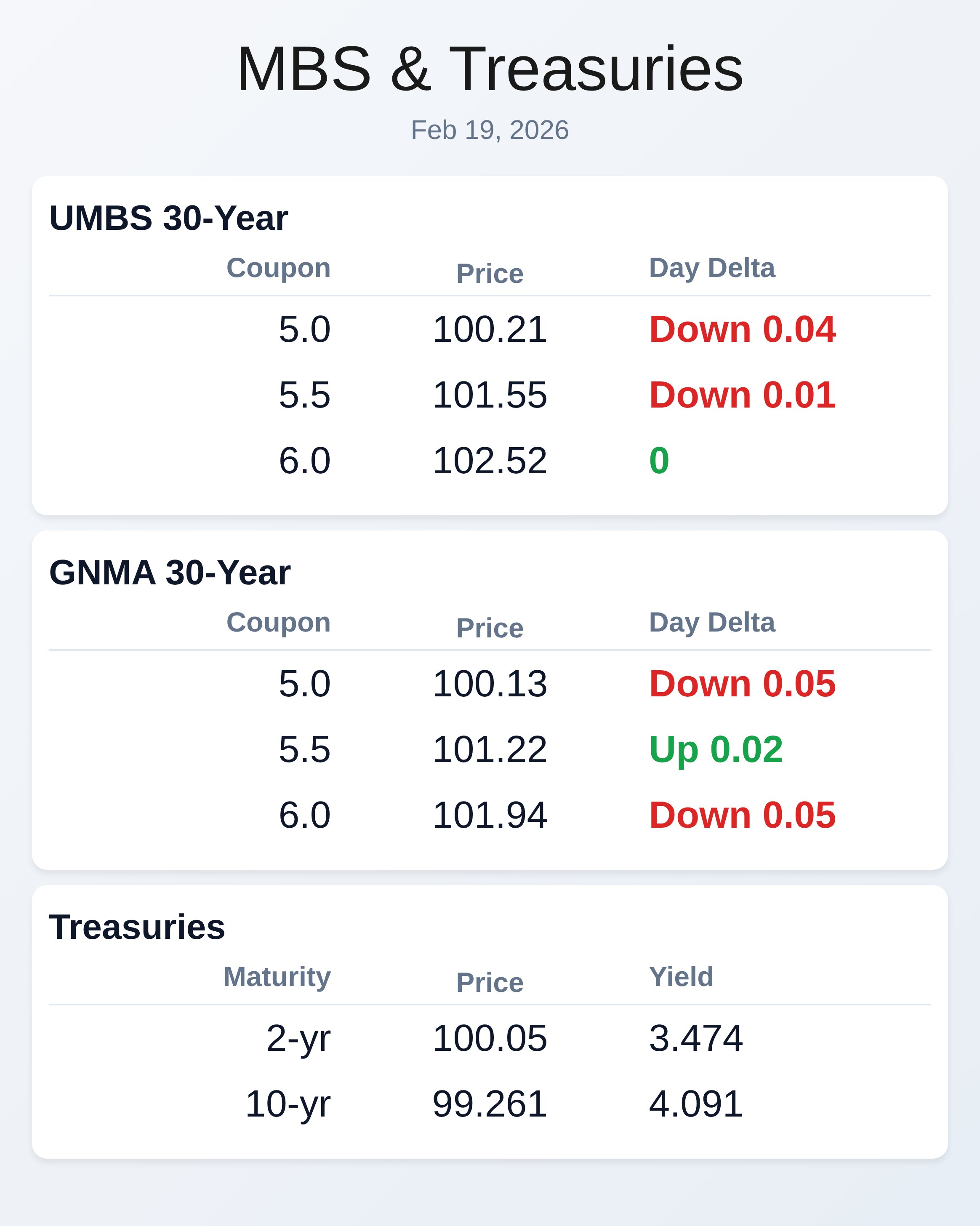

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.21 | -0.04 |

| 5.5 | 101.55 | -0.01 |

| 6.0 | 102.52 | 0 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.13 | -0.05 |

| 5.5 | 101.22 | 0.02 |

| 6.0 | 101.94 | -0.05 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.474 | 100.05 | 0.009 |

| 3 yr | 3.51 | 99.973 | 0.013 |

| 5 yr | 3.661 | 100.402 | 0.013 |

| 7 yr | 3.861 | 100.847 | 0.009 |

| 10 yr | 4.091 | 99.261 | 0.013 |

| 30 yr | 4.718 | 98.522 | 0.01 |