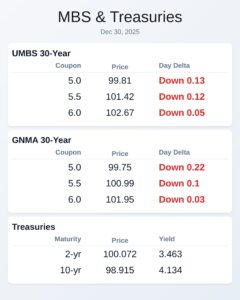

WTMS Blog Today = What's up in Mortgage Today (AM) - 12/30/2025 Bond markets enter peak holiday mode as we approach the final trading day of 2025. MBS prices declined modestly overnight with 30-year UMBS 5.0 coupon down 9 basis points to 99.85. The 10-year Treasury yield climbed to 4.14%, up 29 basis points from yesterday's close. Volatility becomes more unpredictable during these holiday periods despite historically sideways movement patterns. Trading volumes remain light as many market participants continue year-end vacations. The lack of significant news flow means sudden movements can occur without apparent catalysts, making pricing decisions more challenging for originators. October housing data provided mixed signals for the mortgage market. Case-Shiller home prices rose 1.3% year-over-year, slightly above the 1.1% forecast. FHFA home price index gained 0.4% monthly, beating expectations of 0.1%, while Chicago PMI improved to 43.5 from 36.3 previously. J.P. Morgan is bringing $587.6 million of non-QM mortgage exposure to market through their 2025-NQM5 securitization. The deal includes 1,611 first-lien loans with 44.5% designated non-QM, showing continued investor appetite for alternative mortgage products. Nearly 73% of borrowers maintain FICO scores above 720, demonstrating solid credit quality despite non-traditional documentation. President Trump hinted at having a preferred candidate for Fed Chair but remains in no hurry to announce. He also suggested he might fire Jerome Powell, adding political uncertainty to an already volatile rate environment. These comments could influence bond market sentiment as we enter 2026. Locking vs Floating Bond markets are entering peak holiday trading mode with wider movement ranges possible for no apparent reason. The next risk for consequential volatility won't arrive until the first week of January. MBS prices dropped an eighth with 10-year yields up 2.7 basis points at 4.135 this morning, suggesting modest weakness overnight. Today's Events - Case Shiller Home Prices-20 y/y (Oct): 1.3% vs 1.1% forecast, 1.4% previous - FHFA Home Price Index m/m (Oct): 0.4% vs 0.1% forecast, 0% previous - Chicago PMI (Dec): 43.5 vs 39.5 forecast, 36.3 previous - FOMC Minutes from December meeting at 2:00 PM Bond Pricing UMBS 30 yr | Coupon | Price | Intra-Day Change | | 5.0 | 99.81 | -0.13 | | 5.5 | 101.42 | -0.12 | | 6.0 | 102.67 | -0.05 | GNMA 30 yr | Coupon | Price | Intra-Day Change | | 5.0 | 99.75 | -0.22 | | 5.5 | 100.99 | -0.1 | | 6.0 | 101.95 | -0.03 | Treasuries | Term | Yield | Price | Intra-Day Yield Change | | 2 yr | 3.463 | 100.072 | 0.006 | | 3 yr | 3.517 | 99.952 | 0.013 | | 5 yr | 3.688 | 99.713 | 0.019 | | 7 yr | 3.902 | 99.077 | 0.024 | | 10 yr | 4.134 | 98.915 | 0.023 | | 30 yr | 4.819 | 96.938 | 0.023 |