WTMS Blog Today = What’s up in Mortgage Today (PM) – 01/06/2026

Mortgage bonds struggled today as trading volume returned to normal levels after the holiday break. UMBS 30-year securities dropped across all coupons, with the 5.0% coupon falling 9 basis points to 99.72. This weakness directly translates to higher rates for originators pricing loans this afternoon.

The bond market has been trapped in a trading range since December 10th, with 10-year Treasury yields oscillating between 4.10% and 4.20%. Even though volume surged back to typical levels, meaningful volatility remains absent until economic data provides direction. Wednesday and Friday’s employment-related releases represent the best opportunities for a breakout from this sideways pattern.

Defense spending comments pushed markets to their weakest levels of the day around 10:37 AM. Both UMBS and Treasury securities sold off simultaneously, with the 10-year yield climbing 2.4 basis points to 4.187%. This coordinated weakness across fixed-income markets suggests broader concerns about fiscal policy moving forward.

Economic data disappointed expectations with both S&P Global PMI readings falling short. The Composite PMI came in at 52.7 versus 53.0 forecast, while Services PMI registered 52.5 against 52.9 expected. These weaker readings indicate slowing economic momentum but weren’t enough to rally bonds given the broader market context.

Manufacturing continues its contraction streak, now extending to 10 consecutive months of weakness. The ISM Manufacturing Index dropped to 47.9 in December, marking the steepest year-end decline since 2024. Companies are drawing down inventories at the fastest pace since October 2024 to meet softening demand, supporting the case for eventual Fed rate cuts.

Capital markets analysts see limited systemic risks despite geopolitical tensions in Venezuela. Bond yields remain within recent trading ranges while oil holds steady around $55-60 per barrel. The market’s focus is shifting back to domestic fundamentals, particularly labor market data that could influence Federal Reserve policy decisions.

Trump Administration housing policies are gaining attention among mortgage finance professionals. Key proposals include potentially halting or reversing recent conforming loan limit increases, which critics argue artificially inflate home prices. The administration also faces decisions on GSE capital requirements for independent mortgage banks and re-engaging Federal Home Loan Banks as liquidity providers for the mortgage market.

Locking vs Floating

Bond markets are exiting holiday mode with yields effectively unchanged from December 11th levels. The trading range between 4.10-4.20% on 10-year yields continues to dominate, requiring a meaningful breakout for directional clarity. Economic data scheduled for Wednesday and Friday represents the most likely catalyst for volatility that could influence rate direction.

MBS prices help manage intraday risk while 10-year yield levels track broader bond market momentum. Current market conditions favor cautious positioning given the lack of clear directional signals.

Today’s Events

S&P Global Composite PMI (Dec): 52.7 vs 53.0 forecast, 54.2 previous

S&P Global Services PMI (Dec): 52.5 vs 52.9 forecast, 54.1 previous

Bond Pricing

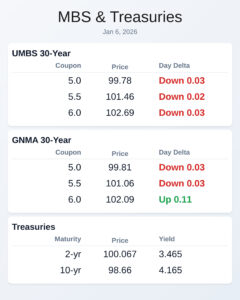

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.72 | -0.09 |

| 5.5 | 101.41 | -0.08 |

| 6.0 | 102.68 | -0.04 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.74 | -0.1 |

| 5.5 | 101.03 | -0.06 |

| 6.0 | 101.94 | -0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.479 | 100.041 | 0.027 |

| 3 yr | 3.546 | 99.87 | 0.027 |

| 5 yr | 3.732 | 99.518 | 0.027 |

| 7 yr | 3.949 | 98.796 | 0.025 |

| 10 yr | 4.189 | 98.47 | 0.026 |

| 30 yr | 4.875 | 96.084 | 0.033 |