WTMS Blog Today = What’s up in Mortgage Today (PM) – 02/03/2026

President Trump’s housing policy stance is creating mixed signals in mortgage markets today. He declared his administration will prioritize keeping home prices high while seeking to make homeownership more accessible, arguing that rising property values represent crucial household wealth that shouldn’t be eroded. This balancing act between maintaining homeowner equity and improving affordability presents challenges for mortgage originators navigating client expectations.

HUD announced sweeping citizenship verification requirements for nearly 200,000 public housing tenants nationwide. Housing authorities must complete eligibility checks within 30 days or face federal sanctions, following an audit that identified approximately 25,000 deceased tenants and 6,000 potentially ineligible residents. This enforcement action stems from the Trump administration’s “American Housing Programs for American Citizens” initiative launched in March 2025.

The former Sprout Mortgage CEO’s wife has launched a new lending company amid ongoing bankruptcy proceedings. Elizabeth Strauss founded Investor Funding Corp. in California, licensed in four states with three employees including a former Sprout servicing executive.

While Michael Strauss shows no formal involvement, this development highlights continued industry consolidation challenges. A Florida federal judge denied a flat-fee broker’s attempt to force NAR and MLSs to enforce their own commission rules. Jorge Zea of SnapFlatFee.com failed to meet procedural deadlines in his challenge against alleged coordination to protect traditional commission structures.

The ruling blocks early efforts to address buyer agent steering practices that harm alternative brokerage models. Trump unveiled Project Vault, a $12 billion strategic stockpile of critical minerals to reduce Chinese supply dependencies. The initiative combines $10 billion in Export-Import Bank financing with $1.7 billion in private capital to store rare earths, gallium, and cobalt used in electronics and batteries.

This represents the bank’s largest deal ever, more than doubling their previous record.

Locking vs Floating

Markets showed mixed behavior today with MBS outperforming Treasuries despite sideways movement. The 10-year yield recovered from earlier weakness to close near 4.27%, while UMBS securities posted modest gains.

Wednesday’s ISM Services and ADP employment data become critical focal points given government shutdown delays affecting other key reports.

Today’s Events

ISM Manufacturing Employment (Jan): 48.1 vs 44.9 previous

ISM Manufacturing PMI (Jan): 52.6 vs 48.5 forecast, 47.9 previous

ISM Manufacturing Prices Paid (Jan): 59.0 vs 60.5 forecast, 58.5 previous

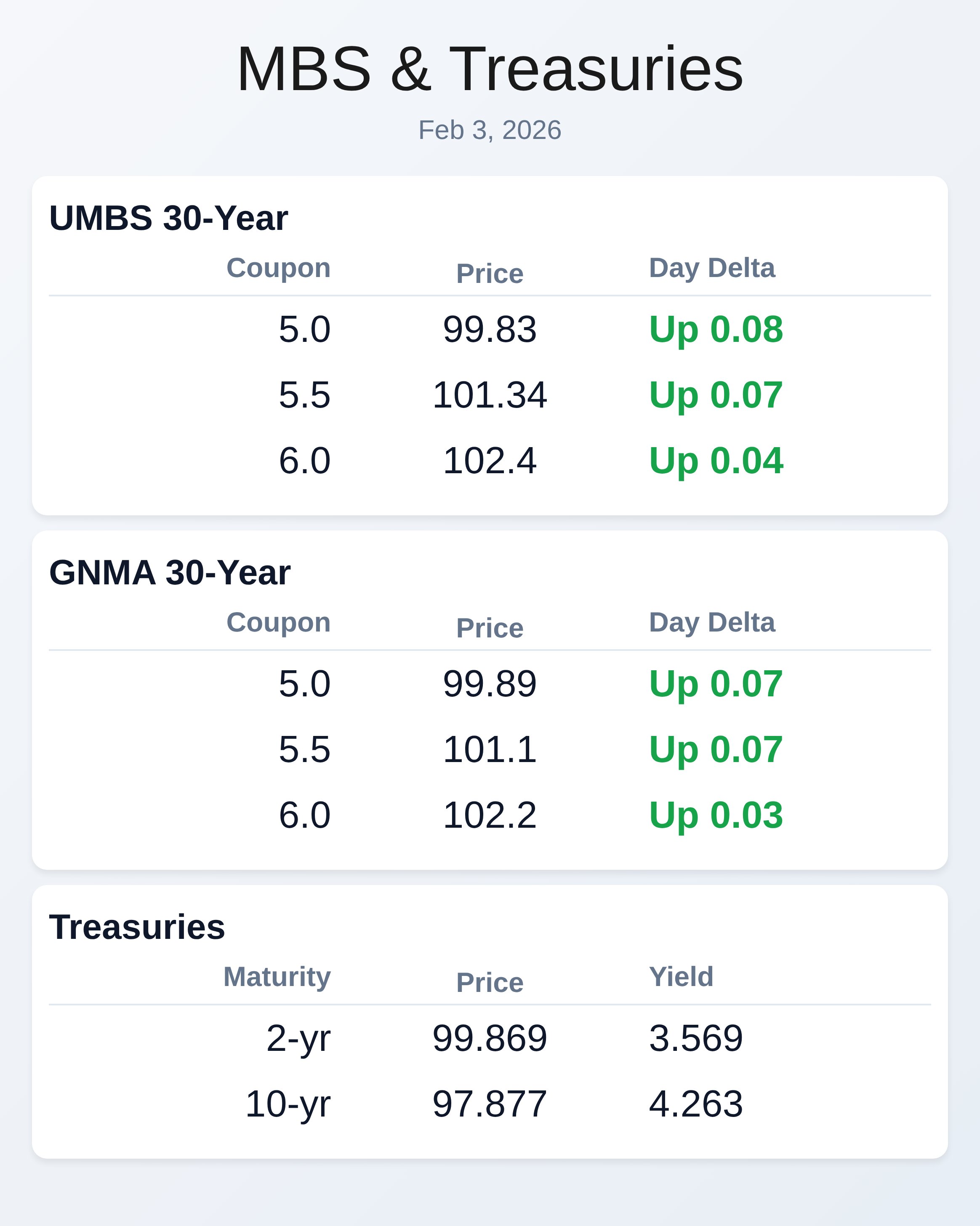

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.83 | 0.08 |

| 5.5 | 101.34 | 0.07 |

| 6.0 | 102.4 | 0.04 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.89 | 0.07 |

| 5.5 | 101.1 | 0.07 |

| 6.0 | 102.2 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.569 | 99.869 | -0.003 |

| 3 yr | 3.643 | 99.596 | -0.001 |

| 5 yr | 3.831 | 99.636 | -0.006 |

| 7 yr | 4.043 | 99.743 | -0.013 |

| 10 yr | 4.263 | 97.877 | -0.018 |

| 30 yr | 4.895 | 95.782 | -0.017 |