WTMS Blog Today = What’s up in Mortgage Today (PM) – 02/06/2026

Home Price Reality Check

The housing market just delivered a sobering dose of reality that mortgage originators need to understand. Clear Capital’s Home Data Index revealed that home price appreciation decelerated sharply in January, dropping 0.6% quarterly while managing only a modest 1.7% annual gain. This dramatic slowdown represents a significant shift from the red-hot markets we’ve grown accustomed to over the past few years.

Regional performance tells an even more concerning story for mortgage professionals. Only the Northeast managed positive growth at 0.3% quarterly, while the West, South, and Midwest all posted declines. New York City emerged as the unexpected winner with 1.0% quarterly growth and a solid 5.8% annual increase, proving that urban markets may be finding their footing again.

MBS Markets Show Promise

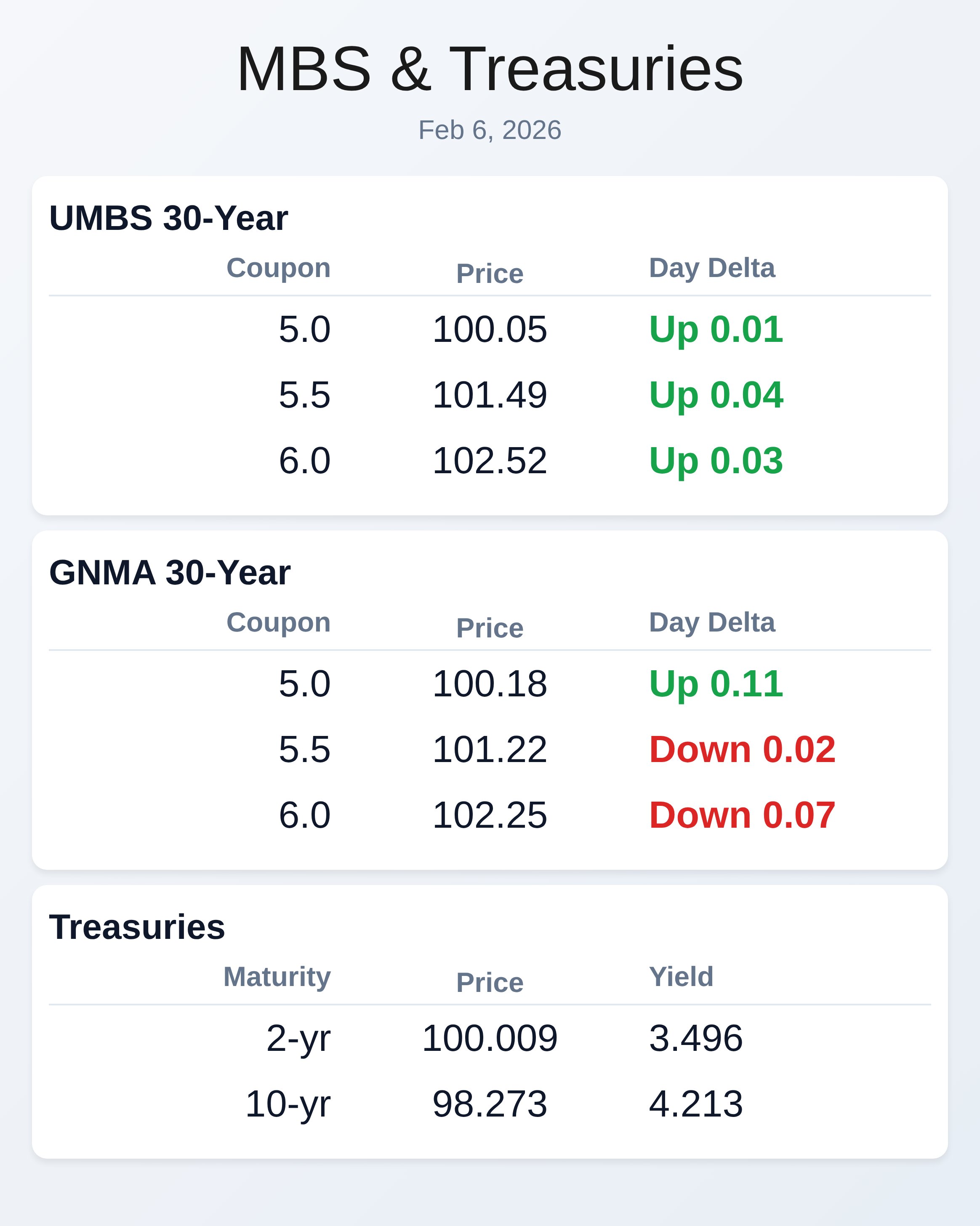

Mortgage-backed securities demonstrated impressive resilience today, outperforming Treasuries in a move that could signal renewed GSE buying activity. UMBS coupons across the board posted gains, with the 6.0 coupon leading at 102.52, up 3 basis points for the day. This outperformance is particularly noteworthy given that Treasury yields climbed across the curve, with the 10-year hitting 4.213%.

The afternoon session brought the best levels of the day for MBS, gaining 1 tick while the 10-year Treasury actually declined 2.9 basis points to 4.21%. This divergence suggests institutional buyers may be rotating back into mortgage securities, potentially providing more stable pricing for originators heading into next week. Economic Sentiment Improves

Consumer sentiment data provided a mixed but generally encouraging picture for the mortgage market.

The University of Michigan’s Consumer Sentiment Index rose to 57.3 in February, beating forecasts of 55.0 and improving from January’s 56.4 reading. More importantly for mortgage originators, one-year inflation expectations dropped to 3.5% from 4.0%, while five-year expectations held relatively steady at 3.4%. Pennymac Takes a Hit

Pennymac Financial Services stock crashed 38% over two trading days following earnings, despite production increasing 10% year-over-year.

While this growth rate lagged behind some competitors, it wasn’t terrible by current market standards, suggesting investors may be applying increasingly harsh scrutiny to mortgage originator performance.

Locking vs Floating

Thursday’s labor market data has set the stage for next Wednesday’s jobs report to be a potential market mover. With no major economic releases remaining this week, the focus shifts to whether employment data will support a return to previous trading ranges or confirm the recent breakout in rates.

A tactical overnight float opportunity exists for certain lenders, similar to yesterday’s successful strategy, though to a much smaller extent. If you don’t see positive repricing this afternoon, you’ll have a few ticks of cushion heading into Monday’s rate sheets, but this carries higher risk given potential weekend geopolitical volatility.

Today’s Events

– Consumer Sentiment (Feb): 57.3 vs 55 forecast, 56.4 previous

– Sentiment: 1y Inflation (Feb): 3.5% vs 4% previous

– Sentiment: 5y Inflation (Feb): 3.4% vs 3.3% previous

– U Mich conditions (Feb): 58.3 vs 54.9 forecast, 55.4 previous

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.05 | 0.01 |

| 5.5 | 101.49 | 0.04 |

| 6.0 | 102.52 | 0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.18 | 0.11 |

| 5.5 | 101.22 | -0.02 |

| 6.0 | 102.25 | -0.07 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.496 | 100.009 | 0.037 |

| 3 yr | 3.567 | 99.812 | 0.036 |

| 5 yr | 3.753 | 99.987 | 0.027 |

| 7 yr | 3.965 | 100.213 | 0.016 |

| 10 yr | 4.213 | 98.273 | 0.028 |

| 30 yr | 4.851 | 96.455 | 0.008 |

Subscribe free at WellThatMakesSense.com to get this analysis in your inbox daily.