WTMS Blog Today = What’s up in Mortgage Today (PM) – 02/12/2026

Bond markets delivered an extraordinary surprise Thursday afternoon, with yields plunging to their lowest levels in two months despite mixed economic data. The 10-year Treasury yield crashed 7 basis points to 4.103%, while UMBS 5.5 coupons surged 16 ticks in what traders describe as a “magical and mysterious” rally. This dramatic reversal caught most market participants off guard after morning weakness.

The Consumer Financial Protection Bureau faces a dramatic transformation under the new administration, creating uncertainty for mortgage lenders nationwide. The agency has retreated from aggressive enforcement, with most staff on administrative leave while a skeleton crew handles basic maintenance functions. State-level consumer protection agencies are stepping up to fill the void, creating a patchwork of enforcement that particularly challenges multi-state lenders.

Kansas City Fed President Jeff Schmid delivered hawkish commentary warning that further rate cuts risk allowing inflation to persist above the Fed’s 2% target. He emphasized that monetary policy actions, not market forces, ultimately determine whether price shocks become transitory or permanent. With inflation currently running closer to 3% than 2%, Schmid cautioned against premature policy easing that could entrench higher price levels.

Thursday’s 30-year bond auction provided significant support to the rally, coming in at 4.75% versus 4.771% expectations with strong demand metrics. The bid-to-cover ratio jumped to 2.66 from the 2.36 average, indicating robust institutional appetite. This successful auction helped fuel the afternoon’s momentum alongside equity market weakness.

Existing home sales disappointed dramatically, falling to 3.91 million versus 4.18 million forecasts and 4.27 million previously. This represents a significant deceleration in housing market activity, though the data may be impacted by seasonal factors and inventory constraints. Weekly jobless claims came in slightly above expectations at 227K versus 222K forecasted.

Locking vs Floating

Thursday’s paradoxical bond rally has completely altered the risk equation for rate lock decisions. The mysterious momentum that drove yields to two-month lows may already be exhausted, creating uncertainty about sustainability. Risk-tolerant clients typically wait for markets to demonstrate direction before adjusting strategies, while conservative borrowers are weighing Friday’s CPI volatility potential against current favorable levels.

Today’s Events

– Continued Claims (Jan 31): 1,862K vs 1,850K forecast, 1,844K previous

– Jobless Claims (Feb 7): 227K vs 222K forecast, 231K previous

– Existing Home Sales: 3.91M vs 4.18M forecast, 4.27M previous

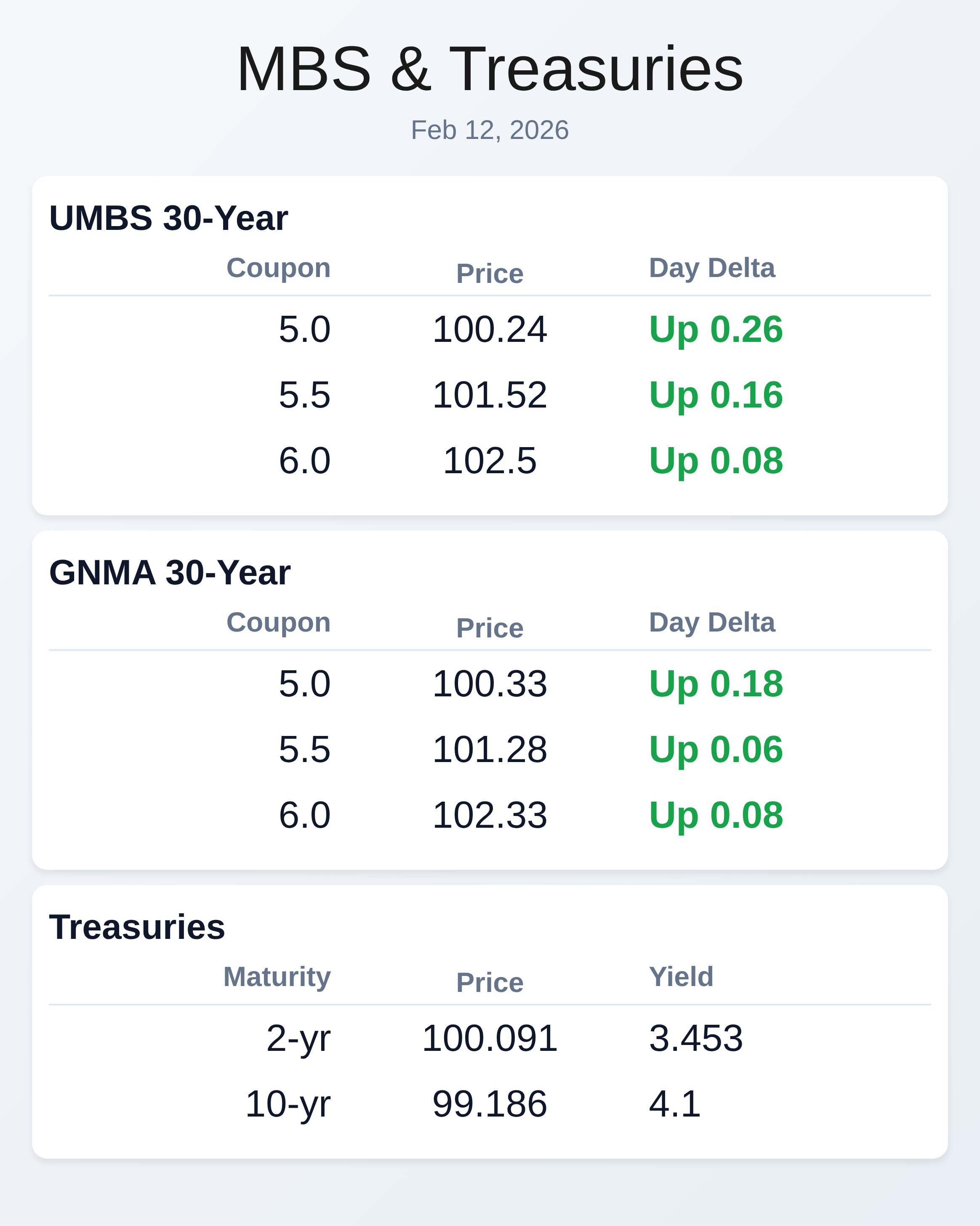

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.24 | 0.26 |

| 5.5 | 101.52 | 0.16 |

| 6.0 | 102.5 | 0.08 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.33 | 0.18 |

| 5.5 | 101.28 | 0.06 |

| 6.0 | 102.33 | 0.08 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.453 | 100.091 | -0.059 |

| 3 yr | 3.5 | 100 | -0.07 |

| 5 yr | 3.655 | 100.43 | -0.088 |

| 7 yr | 3.865 | 100.821 | -0.086 |

| 10 yr | 4.1 | 99.186 | -0.072 |

| 30 yr | 4.737 | 98.219 | -0.074 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.