WTMS Blog Today = What’s up in Mortgage Today (PM) – 02/18/2026

The Federal Reserve is signaling major changes ahead that could reshape the mortgage origination landscape. Fed Governor Michelle Bowman spoke at the American Bankers Association conference about concerns that nonbanks now handle 65% of mortgage origination, up dramatically from just 40% in 2008. The Fed recognizes that overly strict capital requirements may have pushed banks out of the mortgage business when they actually have inherent advantages in servicing.

Fed officials are considering easing capital requirements for mortgage servicing rights, which currently make servicing uneconomical for banks. They’re also exploring risk-based capital formulas that would distinguish between high-LTV and low-LTV loans rather than treating all mortgages the same. While regulatory timelines are lengthy, these changes could eventually bring more competition and tighter margins to the mortgage market.

Fed Governor Michael Barr reinforced the central bank’s current stance on rates, indicating they plan to hold steady for an extended period. “Based on current conditions and the data in hand, it will likely be appropriate to hold rates steady for some time,” Barr stated at a New York economic gathering. This dovish pause suggests mortgage rates may find more stability in coming months.

Homebuilder sentiment dropped to a five-month low as the NAHB/Wells Fargo index fell to 36 in February. Persistent affordability concerns and high construction costs continue weighing on builder confidence. NAHB Chairman Buddy Hughes noted that while builders deploy price cuts and incentives, many prospective buyers remain sidelined, though remodeling demand stays solid due to limited household mobility.

Contract cancellation rates reveal regional stress patterns in the housing market. Atlanta leads with 10.3% of deals falling through, followed by Las Vegas at 10.1% and San Antonio at 9.6%. This comes as existing home sales plummeted 8.4% in January to their slowest pace in over two years, despite mortgage rates hitting a three-year low of 6.09%.

Locking vs Floating

Bond markets are encountering technical resistance as 10-year yields approach the 4% psychological barrier. This resistance pattern, combined with limited 25 basis point rallies since July 2025, creates a more defensive trading environment than usual. The current setup favors caution over aggressive positioning.

Today’s Events

– MBA Purchase Index (Feb 13): 157.1 vs 161.5 previous

– MBA Refi Index (Feb 13): 1375.9 vs 1284.6 previous

– Core Durable Goods (Dec): 0.6% vs 0.4% forecast, 0.7% previous

– Durable Goods (Dec): -1.4% vs -2% forecast, 5.3% previous

– Housing Starts (Dec): 1.404M vs 1.33M forecast

– Housing Starts (Nov): 1.322M vs 1.246M previous

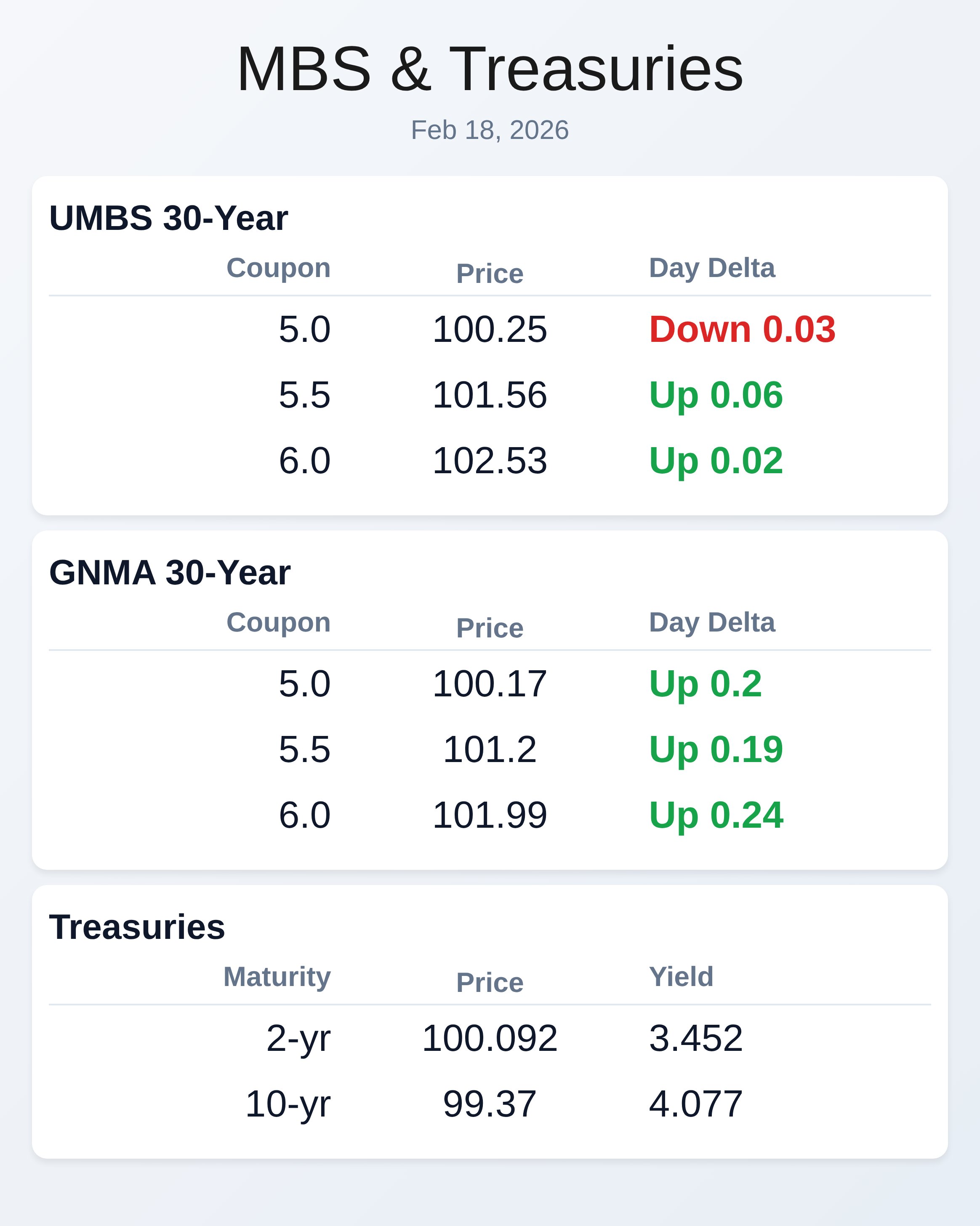

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.25 | -0.03 |

| 5.5 | 101.56 | 0.06 |

| 6.0 | 102.53 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.17 | 0.2 |

| 5.5 | 101.2 | 0.19 |

| 6.0 | 101.99 | 0.24 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.452 | 100.092 | 0.018 |

| 3 yr | 3.497 | 100.008 | 0.03 |

| 5 yr | 3.649 | 100.459 | 0.027 |

| 7 yr | 3.849 | 100.922 | 0.024 |

| 10 yr | 4.077 | 99.37 | 0.018 |

| 30 yr | 4.707 | 98.697 | 0.017 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.