WTMS Blog Today = What’s up in Mortgage Today (PM) – 02/19/2026

Bond markets recovered dramatically from morning weakness, with MBS reaching best levels of the day by 1:38 PM. The UMBS 5.0 coupon climbed 6 basis points while 10-year Treasury yields dropped to 4.068%, a full 3 basis point improvement from morning highs. This afternoon rally suggests investors are positioning defensively ahead of Friday’s heavy economic data calendar.

Strong jobless claims data at 206K versus 225K forecast should have pressured bonds, but markets shrugged off the positive news. The Philadelphia Fed Business Index also beat expectations at 16.3 compared to the 8.5 forecast. Instead of selling on strength, traders appear focused on technical resistance levels and Friday’s potential market-moving releases.

GNMA securities outperformed with the 5.5 coupon gaining 2 basis points, creating better execution opportunities for certain loan products. This divergence between UMBS and GNMA pricing reflects varying investor appetite across security types. For originators, this could mean slightly different pricing depending on your outlet’s preferences for government-backed securities.

The January FOMC meeting minutes revealed the Committee’s comfort with current monetary policy, viewing recent labor market softening as complete. They believe inflation will continue moving toward the 2% target while the labor market gradually improves. With the Fed Funds rate considered near neutral territory, markets are pricing in approximately two more rate cuts this year.

Mortgage servicing rights continue showing resilience despite rate volatility, with values holding just above 6% and down 76 basis points from last year. Housing construction data showed mixed signals with permits falling 7.4% annually, suggesting limited acceleration in building activity. Geopolitical tensions in the Middle East are also contributing to market uncertainty as oil prices spike on potential military action with Iran.

Locking vs Floating

Market technicals favor a defensive approach given the failure to build on recent gains. Friday’s economic data presents two-way risk, but with rates at long-term lows, risk-averse clients remain lock-biased. The current setup suggests caution over optimism for further rate improvements.

Today’s Events

– Jobless Claims (Feb 14): 206K vs 225K forecast, 227K previous

– Philly Fed Business Index (Feb): 16.3 vs 8.5 forecast, 12.6 previous

Bond Pricing

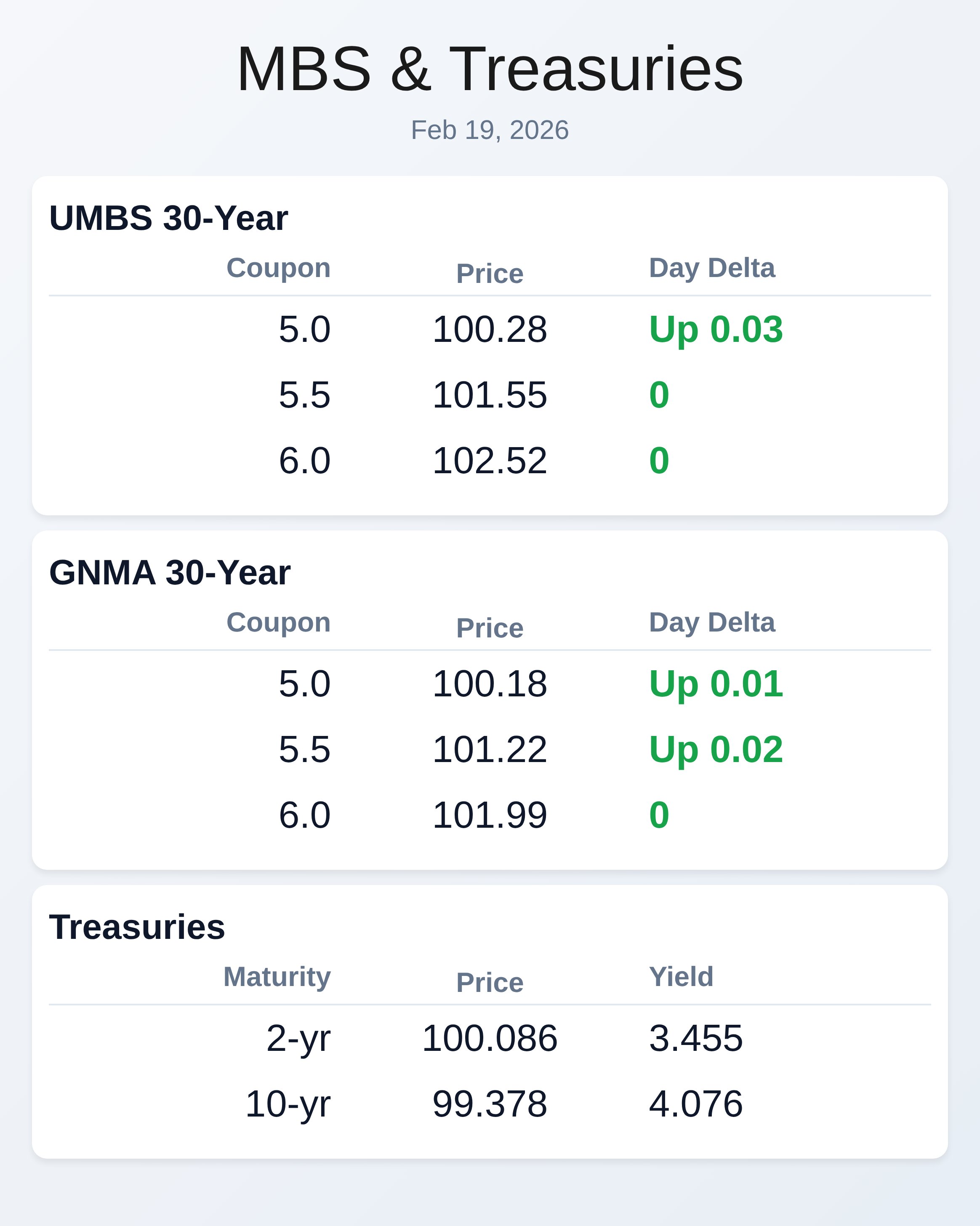

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.28 | 0.03 |

| 5.5 | 101.55 | 0 |

| 6.0 | 102.52 | 0 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.18 | 0.01 |

| 5.5 | 101.22 | 0.02 |

| 6.0 | 101.99 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.455 | 100.086 | -0.01 |

| 3 yr | 3.489 | 100.03 | -0.011 |

| 5 yr | 3.634 | 100.525 | -0.018 |

| 7 yr | 3.837 | 100.993 | -0.015 |

| 10 yr | 4.076 | 99.378 | -0.008 |

| 30 yr | 4.697 | 98.853 | -0.011 |