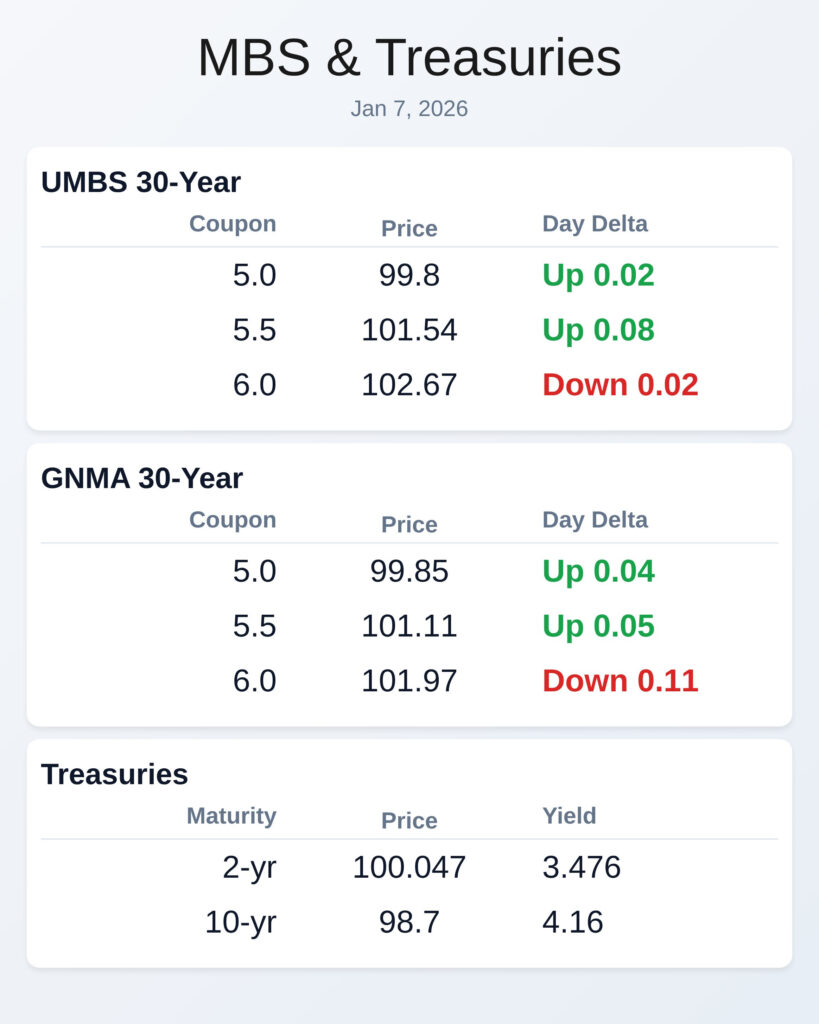

WTMS Blog Today = What's up in Mortgage Today (AM) - 01/07/2026 Mortgage-backed securities started stronger Tuesday night thanks to European bond rallies, but that strength faded fast after Wednesday's 10AM data dump. The ADP employment report showed 41,000 jobs added in December, missing expectations by 6,000, while ISM Services data came in hotter than expected across the board. UMBS 5.0 coupons dropped an eighth of a point from morning highs, and the 10-year Treasury yield climbed back to 4.158% after touching 4.123% earlier. The ISM Services PMI hit 54.4 versus a forecast of 52.3, with employment and new orders showing significant strength. Any time employment components surge like this during NFP week, it creates concern about Friday's jobs report potentially beating expectations. JOLTS job openings fell to 7.146 million, which would normally be bond-friendly, but the "quits rate" increased to 3.161 million, signaling workers feel confident enough to leave their jobs. Credit bureau stocks tumbled Tuesday after FHFA Director Bill Pulte criticized their pricing practices on social media, highlighting that mortgage originators face 40-50% increases in credit reporting costs. First Federal Bank announced it's acquiring Fidelity Bank's mortgage division, NOLA Lending Group, continuing the industry's consolidation trend. MBA appointed Alexandra Brinton as VP and CFO, while a Colorado mortgage originator agreed to pay $31,000 in fines and surrender licenses in 19 states for having someone else complete his required education courses. Home equity lending continued its strong momentum in Q3 2025, with $209.3 billion in originations through the first nine months approaching the post-crisis high of $253 billion set in 2022. Citizens Bank maintained its top position with $3.10 billion in Q3 volume, focusing entirely on HELOCs rather than closed-end seconds. The 2026 first-time homebuyer market includes an estimated 22 million renters earning $50,000-$150,000, though only about 1.4-1.6 million are expected to actually get mortgages. Locking vs Floating Risk-averse originators have an easy decision with average rates sitting very close to long-term lows heading into a data-heavy week. The combination of ADP, JOLTS, and ISM results creates plenty of risk for departure from recent ranges, especially with Friday's official jobs report looming. Markets lost ground after the 10AM releases, with MBS returning to unchanged levels and the 10-year yield climbing 2 basis points from pre-data levels. Today's Events - ADP Employment: 41k vs 47k forecast, -32k previous - ISM N-Mfg PMI: 54.4 vs 52.3 forecast, 52.6 previous - ISM Services Employment: 52.0 vs 48.9 previous - ISM Services New Orders: 57.9 vs 52.9 previous - ISM Services Prices: 64.3 vs 65.4 previous - USA JOLTS Job Openings: 7.146M vs 7.60M forecast, 7.670M previous Bond Pricing UMBS 30 yr | Coupon | Price | Intra-Day Change | | 5.0 | 99.8 | 0.02 | | 5.5 | 101.54 | 0.08 | | 6.0 | 102.67 | -0.02 | GNMA 30 yr | Coupon | Price | Intra-Day Change | | 5.0 | 99.85 | 0.04 | | 5.5 | 101.11 | 0.05 | | 6.0 | 101.97 | -0.11 | Treasuries | Term | Yield | Price | Intra-Day Yield Change | | 2 yr | 3.476 | 100.047 | 0.012 | | 3 yr | 3.534 | 99.904 | 0.008 | | 5 yr | 3.712 | 99.609 | 0.002 | | 7 yr | 3.923 | 98.952 | -0.003 | | 10 yr | 4.16 | 98.7 | -0.009 | | 30 yr | 4.841 | 96.599 | -0.018 |