WTMS Blog Today = What’s up in Mortgage Today (AM) – 01/08/2026

European bond markets dragged U.S. bonds lower overnight in a synchronized selling session. Both markets experienced a 3 basis point selloff before American trading hours began.

This cross-Atlantic weakness set a challenging tone for domestic mortgage markets. The 8:30 AM economic data failed to provide any relief from the morning’s pressure. Jobless claims came in slightly better than expected at 208,000 versus 210,000 forecasted, but this minor positive was quickly overwhelmed by broader market sentiment.

The December Challenger layoffs report showed significant improvement, dropping to 35,553 from 71,321 the previous month. UMBS pricing declined across all major coupons as spreads widened relative to Treasury benchmarks. The 5.0 coupon fell 11 basis points while the 10-year Treasury yield climbed 22 basis points to 4.177%.

This divergence highlights the ongoing pressure mortgage-backed securities face in the current environment. Trump’s announcement regarding potential military spending increases of $500 billion for 2027 added to market uncertainty. Defense stocks rallied on the news while Treasury yields continued their upward trajectory.

The bear steepening pattern suggests investors are preparing for higher long-term rates and increased government borrowing.

Locking vs Floating

With rates sitting at 2-month lows, risk-averse clients should remain in lock mode. Wednesday’s economic data failed to inspire significant volatility, making Friday’s jobs report the week’s last major market-moving event.

The current environment favors protecting gains rather than gambling on further improvements. MBS spreads continue widening despite stable Treasury movements, creating additional headwinds for mortgage pricing. Risk management suggests maintaining defensive positioning until clearer directional signals emerge from economic data.

Today’s Events

Challenger layoffs (Dec): 35.553K vs 71.321K previous

Continued Claims (Dec 27): 1,914K vs 1900K forecast, 1866K previous

Jobless Claims (Jan 3): 208K vs 210K forecast, 199K previous

Trade Gap (Oct): -29.40B vs $-58.9B forecast, $-52.8B previous

Bond Pricing

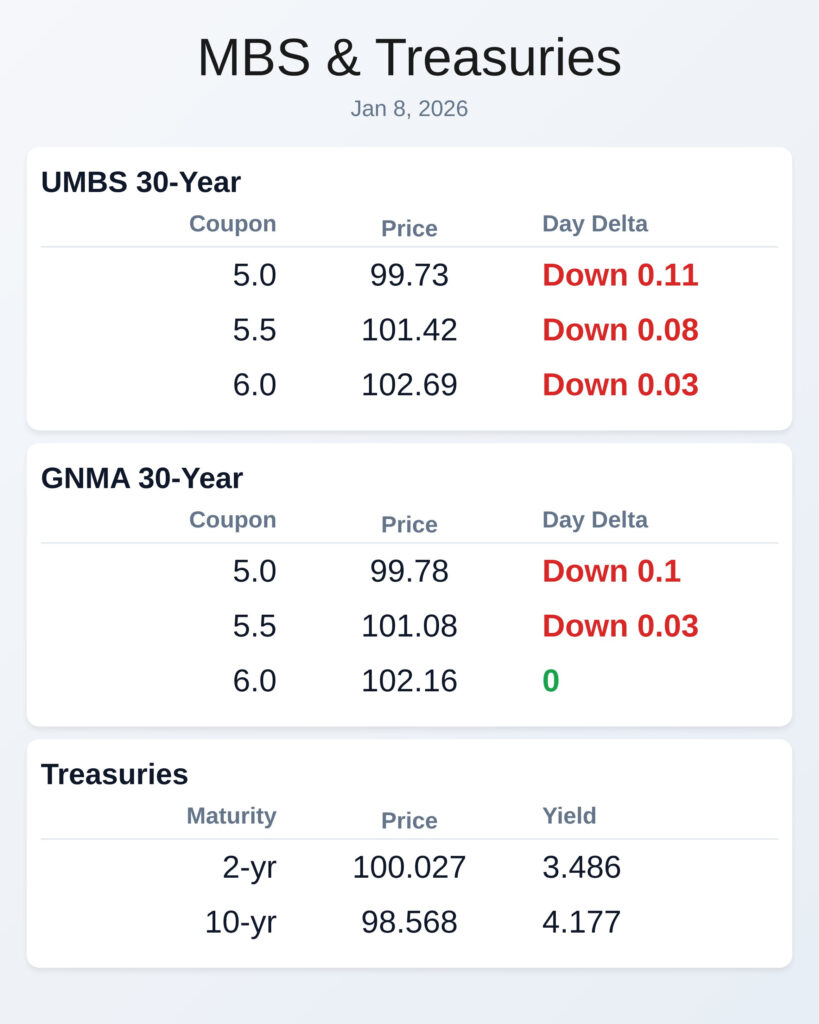

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.73 | -0.11 |

| 5.5 | 101.42 | -0.08 |

| 6.0 | 102.69 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.78 | -0.1 |

| 5.5 | 101.08 | -0.03 |

| 6.0 | 102.16 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.486 | 100.027 | 0.015 |

| 3 yr | 3.549 | 99.862 | 0.022 |

| 5 yr | 3.729 | 99.53 | 0.025 |

| 7 yr | 3.94 | 98.847 | 0.028 |

| 10 yr | 4.177 | 98.568 | 0.022 |

| 30 yr | 4.855 | 96.38 | 0.027 |