WTMS Blog Today = What’s up in Mortgage Today (AM) – 10/23/2025

Oil prices surged 5.5% as the US announced new sanctions on Russia’s biggest oil companies, sparking fresh inflation concerns. This development pushed Treasury yields higher across the curve as traders worried about the Fed’s ability to cut rates more aggressively. The 10-year Treasury climbed four basis points to 3.99%, while UMBS bonds dropped 19 basis points despite staying near recent favorable levels.

The timing couldn’t be more significant with Friday’s Consumer Price Index report looming. This delayed CPI data (originally scheduled for October 15 due to the government shutdown) will give Fed officials crucial information ahead of their October 28-29 policy meeting. Economists expect core CPI to climb 0.3% for a third consecutive month, keeping annual core inflation at 3.1%.

Despite the inflationary pressures from rising oil, most analysts believe Friday’s CPI won’t derail the Fed’s expected rate cut next week. Employment remains the Fed’s primary concern, with NatAlliance Securities noting that “we don’t think the CPI number tomorrow will carry much weight as the Fed meeting starts next Tuesday.” JPMorgan’s trading desk sees a 65% chance stocks advance after CPI, suggesting markets expect Fed easing to offset inflation worries.

Locking vs Floating

Current conditions favor different strategies based on risk tolerance.

Risk-averse clients remain in lock mode as rates continue flirting with longer-term lows. Risk-tolerant clients enjoy the absence of major corrections while waiting for negative volatility to force their hand. Remember that MBS hit weakest levels of the day, though not quite reaching alert territory for most lenders.

Today’s Events

No major economic data scheduled due to government shutdown delays.

Bond Pricing

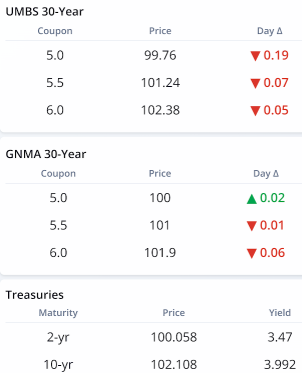

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.76 | -0.19 |

| 5.5 | 101.24 | -0.07 |

| 6.0 | 102.38 | -0.05 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100 | 0.02 |

| 5.5 | 101 | -0.01 |

| 6.0 | 101.9 | -0.06 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.47 | 100.058 | 0.027 |

| 3 yr | 3.476 | 100.068 | 0.033 |

| 5 yr | 3.591 | 100.154 | 0.041 |

| 7 yr | 3.774 | 100.616 | 0.046 |

| 10 yr | 3.992 | 102.108 | 0.045 |

| 30 yr | 4.579 | 102.773 | 0.049 |