WTMS Blog Today = What’s up in Mortgage Today (AM) – 11/12/2025

Bonds opened stronger this morning, riding exclusively on yesterday’s ADP weekly jobs data showing 11,000 job losses. ADP has been publishing monthly payroll counts for years, but their new weekly report is quickly becoming a major market mover. Traders wasted no time incorporating this fresh data into their strategies, pushing mortgage-backed securities up 10 ticks (.31) and dropping 10-year yields by 4.4 basis points to 4.077.

The government shutdown drama continues to influence trading decisions. With the House expected to vote on ending the 43-day shutdown around 7 PM today, volatility could spike once we get confirmation. Markets have already priced in some optimism about resolution, but any unexpected developments could create additional bond weakness.

FHFA Director Bill Pulte announced that Fannie Mae and Freddie Mac will remain in conservatorship despite IPO plans. The administration intends to sell up to 5% of shares via public offering, potentially raising $30 billion while maintaining the government guarantee. This cautious approach preserves the backstop for 70% of the U.S.

mortgage market that these entities support. Mortgage purchase applications jumped 6% last week to their strongest pace since September, according to MBA data. Despite 30-year rates increasing to 6.34% from 6.31%, purchase volume was 31% higher than the same week last year.

Refinance demand dropped 3% but remained 147% above year-ago levels.

Locking vs Floating

The extra day from Veterans Day holiday means additional global market movement and news headlines to consider. With government shutdown resolution on the table, Wednesday’s volatility could be elevated.

If shutdown optimism continues to fuel stock gains and bond losses, confirmation of reopening could imply additional weakness.

Today’s Events

– ADP Weekly Payrolls: -11k (released Tuesday)

– 7:00 AM: MBA Mortgage Market Index

– 1:00 PM: 10-year Note Auction ($42 billion)

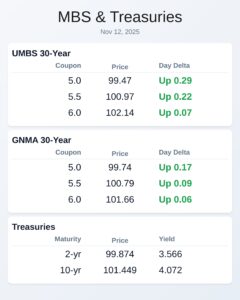

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.47 | 0.29 |

| 5.5 | 100.97 | 0.22 |

| 6.0 | 102.14 | 0.07 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.74 | 0.17 |

| 5.5 | 100.79 | 0.09 |

| 6.0 | 101.66 | 0.06 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.566 | 99.874 | -0.027 |

| 3 yr | 3.562 | 99.824 | -0.041 |

| 5 yr | 3.673 | 99.781 | -0.046 |

| 7 yr | 3.856 | 100.118 | -0.053 |

| 10 yr | 4.072 | 101.449 | -0.046 |

| 30 yr | 4.668 | 101.325 | -0.045 |