WTMS Blog Today = What’s up in Mortgage Today (AM) – 11/17/2025

Bond markets are showing modest strength this morning as September’s delayed jobs report looms large. The UMBS 5.0 coupon gained 2 basis points while the 10-year Treasury yield dropped to 4.138%. This week marks the return of major economic data after the government shutdown.

Thursday’s September jobs report could pack a punch despite being 1.5 months stale. While it won’t be as potent as a timely release, employment data can still move markets significantly. The Fed Minutes on Wednesday should reveal how officials view recent hawkish messaging after last week’s cautious tone.

Fannie Mae eliminated its minimum credit score requirement yesterday, shifting to Desktop Underwriter for borrower assessment. This change opens conventional financing to borrowers with limited credit history or non-traditional credit sources. The move represents a significant shift in how we evaluate loan eligibility.

Rice Park Capital acquired Rosegate Mortgage to integrate loan origination with their $61 billion mortgage servicing rights portfolio. The deal gives Rice Park an in-house recapture channel while Rosegate expands retail and consumer-direct lending operations. This trend of MSR buyers creating origination arms continues reshaping the industry.

Locking vs Floating

Government agencies are rescheduling economic data with limited immediate releases expected. Bonds continue taking cues from stocks and Fed speakers who’ve maintained hawkish messaging recently. Markets will likely struggle until Wednesday’s Fed Minutes provide clarity on policy direction after last week’s cautious comments.

Today’s Events

– ADP Weekly Payrolls (Tuesday): -11k

Bond Pricing

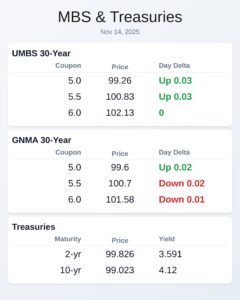

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.18 | 0.02 |

| 5.5 | 100.8 | 0.02 |

| 6.0 | 102.13 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | -0.01 |

| 5.5 | 100.71 | 0.02 |

| 6.0 | 101.55 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.614 | 99.782 | 0.008 |

| 3 yr | 3.612 | 99.685 | 0.002 |

| 5 yr | 3.727 | 99.538 | -0.002 |

| 7 yr | 3.909 | 99.035 | -0.01 |

| 10 yr | 4.138 | 98.883 | -0.012 |

| 30 yr | 4.736 | 98.235 | -0.014 |