WTMS Blog Today = What’s up in Mortgage Today (AM) – 11/18/2025

Bonds are buying the dip this Tuesday morning regardless of mixed economic data releases. The 30-year UMBS 5.0 coupon jumped 19 basis points while the 10-year Treasury yield dropped nearly 5 basis points to 4.10%. This movement comes as economic reports resume after the shutdown with some confusion around previously unannounced rescheduled release dates.

Traders were already positioned to buy bond weakness before morning data hit the wires. ADP’s weekly payroll report showed another decline of 2.5k jobs versus the previous 11.25k drop. Jobless claims came in higher than expected at 232k versus the 223k forecast, suggesting continued labor market softening.

Home Depot’s earnings warning about consumer strain is adding to the risk-off sentiment across markets. The retailer cautioned about weaker demand for big-ticket purchases, which typically signals broader economic concerns. This consumer weakness is supporting the Treasury rally as investors seek safe haven assets.

The Cleveland Fed WARN notices released late Monday may have helped spark the overnight bond rally. These advance layoff warnings often provide early signals about labor market deterioration. Combined with ongoing stock market volatility and concerns about upcoming Nvidia earnings, fixed income is benefiting from flight-to-quality flows.

Market volatility remains elevated but manageable heading into Wednesday’s Fed minutes release. Thursday’s delayed September jobs report will be the key data point for Fed policy expectations despite being somewhat stale. The current environment favors bonds as traders navigate post-shutdown data uncertainty and corporate earnings concerns.

Locking vs Floating

The current environment offers moderate volatility with bonds showing strength after hitting recent range highs. With upcoming Fed minutes Wednesday and Thursday’s stale jobs report, potential volatility will increase throughout the week. MBS prices are providing good intraday support, but 10-year yield levels remain crucial for tracking longer-term momentum.

Today’s Events

– ADP Weekly Payrolls: -2.5k vs -11.25k previous

– Jobless Claims (October 18th): 232k vs 223k forecast, 219k previous

– Factory Orders: 1.4 vs 1.4 forecast, -1.3 previous

– Builder Confidence: 38 vs 37 forecast, 37 previous

– Core Durable Goods (August): 0.4 vs 0.6 forecast/previous

Bond Pricing

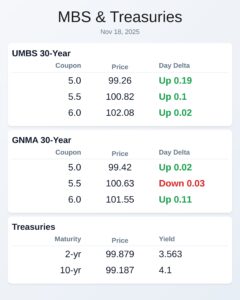

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.26 | 0.19 |

| 5.5 | 100.82 | 0.1 |

| 6.0 | 102.08 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.42 | 0.02 |

| 5.5 | 100.63 | -0.03 |

| 6.0 | 101.55 | 0.11 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.563 | 99.879 | -0.051 |

| 3 yr | 3.561 | 99.828 | -0.054 |

| 5 yr | 3.676 | 99.771 | -0.053 |

| 7 yr | 3.86 | 99.329 | -0.052 |

| 10 yr | 4.1 | 99.187 | -0.039 |

| 30 yr | 4.726 | 98.391 | -0.01 |