WTMS Blog Today = What’s up in Mortgage Today (AM) – 11/19/2025

Mortgage rates climbed to a one-month high this week, sending application demand tumbling 5.2%. The 30-year fixed rate hit 6.37%, up from 6.34% the previous week. This marks the third consecutive week of rate increases, pushing homebuyers back to the sidelines once again.

Treasury yields are following stocks higher in this morning’s session, creating headwinds for mortgage pricing. The correlation between equities and bonds has returned to its traditional pattern after years of Fed intervention disrupting normal relationships. When stocks rally, safe-haven demand for bonds typically diminishes, pushing yields upward.

Today’s key focus centers on the Fed Minutes release at 2:00 PM ET. Markets expect the document to reveal a deeply divided committee with growing concerns about employment weakness versus persistent inflation pressures. This release could trigger significant volatility in both Treasury and MBS markets.

The MBA data shows refinance applications fell 7% despite being 125% higher than last year. Purchase applications dropped 2% but maintained a 26% year-over-year gain. Potential homebuyers are clearly rate-sensitive, moving to the sidelines as borrowing costs increase.

Locking vs Floating

This morning started flat but has deteriorated since the 9:30 AM market open. Bonds are losing ground as stock recovery saps safe-haven demand seen earlier this week. Volatility potential remains moderate but will increase surrounding today’s Fed minutes and tomorrow’s delayed jobs report.

Today’s Events

– ADP Weekly Payrolls: -2.5k vs -11.25k previous

– Jobless Claims: 232k vs 223k forecast, 219k previous

– Factory Orders: 1.4 vs 1.4 forecast, -1.3 previous

– Builder Confidence: 38 vs 37 forecast, 37 previous

– Core Durable Goods: 0.4 vs 0.6 forecast/previous

– 2:00 PM: FOMC Minutes

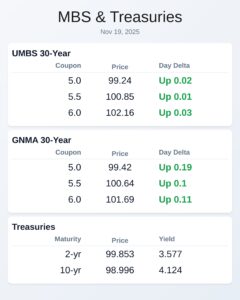

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.24 | 0.02 |

| 5.5 | 100.85 | 0.01 |

| 6.0 | 102.16 | 0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.42 | 0.19 |

| 5.5 | 100.64 | 0.1 |

| 6.0 | 101.69 | 0.11 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.577 | 99.853 | 0.001 |

| 3 yr | 3.574 | 99.792 | 0.003 |

| 5 yr | 3.694 | 99.688 | 0.014 |

| 7 yr | 3.884 | 99.184 | 0.008 |

| 10 yr | 4.124 | 98.996 | 0.007 |

| 30 yr | 4.746 | 98.07 | 0.013 |