WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/02/2025

Markets experienced an eerie calm after morning volatility as mortgage-backed securities held steady. The UMBS 5.0 coupon traded at 99.54 with minimal movement throughout the session. This stability comes despite underlying economic data showing continued manufacturing weakness.

The ISM Manufacturing Employment index fell to 44.0 in November, dropping from October’s 46.0 reading. Manufacturing PMI also disappointed at 48.2, slightly below the 48.6 forecast and marking nine consecutive months below the 50 contraction threshold. These weak manufacturing numbers actually helped bond prices as investors sought safer assets.

Treasury yields crept higher across the curve, with the 10-year climbing 21 basis points to 4.110 percent. Global bond markets felt pressure from Japanese government bond selling, as markets price in a potential Bank of Japan rate hike in December. When Japanese rates rise, it can pull capital away from U.S.

Treasuries, pushing our yields higher. The artificial intelligence theme continues dominating mortgage industry discussions. STRATMOR released new research titled “Artificial Intelligence in Mortgage Lending,” addressing whether AI loan officers should be licensed.

As agentic AI systems make autonomous decisions with limited human intervention, regulators are grappling with oversight questions that could reshape lending operations. Guild Mortgage’s acquisition by Bayview exemplifies ongoing M&A activity in the sector. STRATMOR’s Garth Graham expects over 40 deals in 2025, demonstrating this isn’t just weak companies selling.

Guild’s $47 million third-quarter adjusted net income and $100 billion servicing portfolio show strong companies are making strategic moves.

Locking vs Floating

Holiday volatility has settled into familiar November trading ranges. Economic data poses the primary risk for rate movement in coming days.

Risk-reward calculations become more straightforward as markets await next week’s Fed meeting decision.

Today’s Events

– ISM Manufacturing Employment (Nov): 44.0 vs 46.0 prev

– ISM Manufacturing PMI (Nov): 48.2 vs 48.6 f’cast, 48.7 prev

– ISM Mfg Prices Paid (Nov): 58.5 vs 59.5 f’cast, 58.0 prev

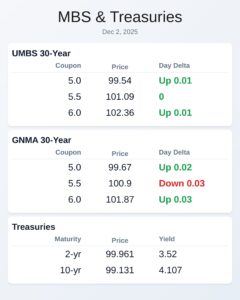

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.54 | 0.01 |

| 5.5 | 101.09 | 0 |

| 6.0 | 102.36 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.67 | 0.02 |

| 5.5 | 100.9 | -0.03 |

| 6.0 | 101.87 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.52 | 99.961 | -0.01 |

| 3 yr | 3.541 | 99.884 | -0.004 |

| 5 yr | 3.672 | 99.788 | 0.004 |

| 7 yr | 3.87 | 99.273 | 0.013 |

| 10 yr | 4.107 | 99.131 | 0.019 |

| 30 yr | 4.762 | 97.829 | 0.023 |