WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/03/2025

Mortgage markets started strong this morning with significant bond price gains despite the weak ADP jobs report showing only modest market reaction. The 10-year Treasury yield dropped 3 basis points to 4.06% before the employment data even hit, suggesting other factors are driving the rally. UMBS 5.0 coupons gained over an eighth of a point in the early session.

The ADP Employment report delivered a shocking -32,000 jobs versus the +10,000 forecast, representing the largest private payroll decline since early 2023. However, markets showed surprisingly little reaction to this weak data in terms of volume and volatility. Most of today’s bond market gains actually occurred between 6:00 AM and 7:30 AM ET, well before the jobs number was released.

MBS production costs continue climbing according to Freddie Mac’s latest Cost to Originate Study, with retail lenders spending an average of $11,800 per loan in Q2 2025. This represents a slight improvement from Q1’s $13,400 but remains well above year-earlier levels. Lenders using Freddie’s Loan Product Advisor digital capabilities can save roughly $1,700 per loan, a 13% increase from 2024 savings.

Absolute Home Mortgage acquired assets of Fidelity Direct Mortgage in a strategic partnership designed to enhance operational scale and broaden product access. The deal adds FDM’s 55 loan officers who originated $335 million over the past year to Absolute’s existing platform of 190 LOs producing $1 billion annually. FDM president Maria D’Souza-Datta joins Absolute as executive operations manager and board member.

Locking vs Floating

Wednesday brings the week’s heaviest economic data releases with ADP and ISM Services leading the charge. New month and week volatility appears to be behind us after Monday’s one-time event and Tuesday’s calm session. However, volatility risk continues through Friday as consistent economic data releases hit the market throughout the remainder of the week.

Today’s Events

– ADP Employment: -32k vs 10k forecast, 42k previous

– ISM Business Activity (Nov): 54.5 vs forecast unavailable, 54.3 previous

– ISM Services PMI (Nov): 52.6 vs 52.1 forecast, 52.4 previous

– ISM Services Employment (Nov): 48.9 vs forecast unavailable, 48.2 previous

– ISM Services New Orders (Nov): 52.9 vs forecast unavailable, 56.2 previous

– ISM Services Prices (Nov): 65.4 vs forecast unavailable, 70.0 previous

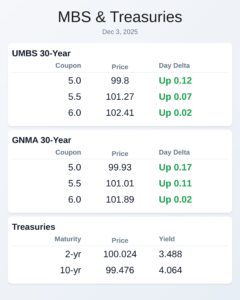

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.8 | 0.12 |

| 5.5 | 101.27 | 0.07 |

| 6.0 | 102.41 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.93 | 0.17 |

| 5.5 | 101.01 | 0.11 |

| 6.0 | 101.89 | 0.02 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.488 | 100.024 | -0.022 |

| 3 yr | 3.504 | 99.99 | -0.025 |

| 5 yr | 3.629 | 99.98 | -0.031 |

| 7 yr | 3.826 | 99.539 | -0.028 |

| 10 yr | 4.064 | 99.476 | -0.027 |

| 30 yr | 4.733 | 98.274 | -0.01 |

Subscribe free at WellThatMakesSense.com to get this analysis in your inbox daily.